ClickFunnels 2.0 is lastly right here!

With it comes a complete swathe of latest options — a full-blown CRM, visible funnel editor, course creator, membership website, eCommerce functionalities, and plenty extra…

…equivalent to Funds.AI

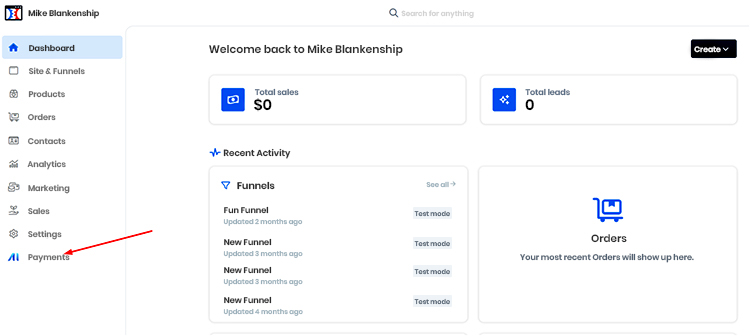

Should you’re a member, you might need seen this tab in your ClickFunnels 2.0 menu…

That’s your direct entry to our Funds.AI platform.

Let’s discuss what it’s.

What’s Funds.AI?

Funds.AI is a hub for ClickFunnels 2.0 members to view transactions, handle cost gateways, and create customized automations relating to issues like trial-ending reminders, bank card expiration reminders, and subscription dunning.

That’s a mouthful.

So let’s break it down.

Right here’s a high-level overview of what you’ll handle within your Funds.AI account vs. your ClickFunnels account (with hyperlinks to a few of our assist articles)…

Overview of what you possibly can arrange from ClickFunnels Account:

- Create, handle, and edit subscriptions

- Create, handle, and edit trials

- Create and edit merchandise

- Create orders

- Course of funds and refunds

- Ship an bill

Overview of what you arrange out of your Funds AI Account:

Getting Began With Funds.AI

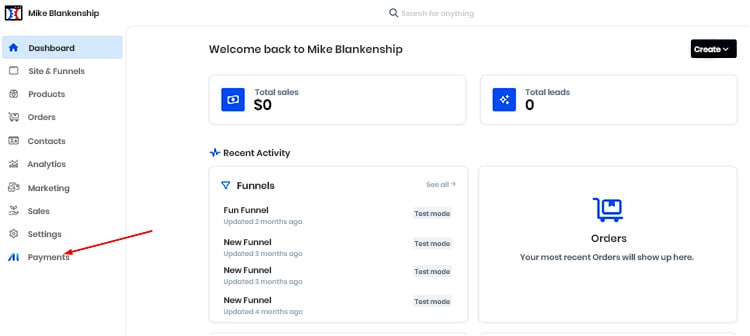

Getting arrange with Funds.AI is as straightforward as clicking on this button in your CF 2.0 account after which following the steps and answering some questions.

When you do, you’ll be taken to the Funds.AI platform, which is distinct from the ClickFunnels 2.0 platform (however routinely connects to your CF 2.0 account as soon as arrange).

Select the nation the place you use and ensure (or say “No) that you simply don’t promote objects on our restricted checklist.

Right here’s what’s on our restricted checklist…

- Monetary consulting companies

- Resellers with out proof of agreements – in case you are a reseller of a services or products you need to acquire the suitable reseller certificates or permission

- International Forex Change companies or software program, binary choices

- Dwell animals

- Medical Profit Packages, low cost medical playing cards, Medical/remedy companies, medical session companies, dental plans

- Unapproved medication and gadgets mimicking unlawful medication

- Cellphone unlock companies, Jailbreakers

- Satellite tv for pc, Cable sign decoders/playing cards

- Digital Credit score

- Digital gaming chips, credit, penny auctions, auctions with a non-refundable bid or participation charges

- Weapons, Firearms, ammunition, explosives, hazardous supplies, combustibles, knives

- Crowdfunding

If what you promote falls into a kind of classes, then choose “No” and also you’ll have the ability to arrange a Funds.AI account — you simply gained’t have the ability to use the Funds.AI gateway, however you possibly can nonetheless join different cost gateways which could will let you promote your services or products.

You may additionally discover that your nation is restricted by the Funds.AI gateway. If that’s the case, then the identical scenario applies.

In any other case, you’ll be taken by the easy and simple Funds.AI software so you need to use the Funds.AI cost gateway (which can prevent a little bit bit of cash… extra on that underneath “Pricing” on this article).

Both manner, you’ll quickly arrive at your dashboard!

Your Funds.AI Dashboard

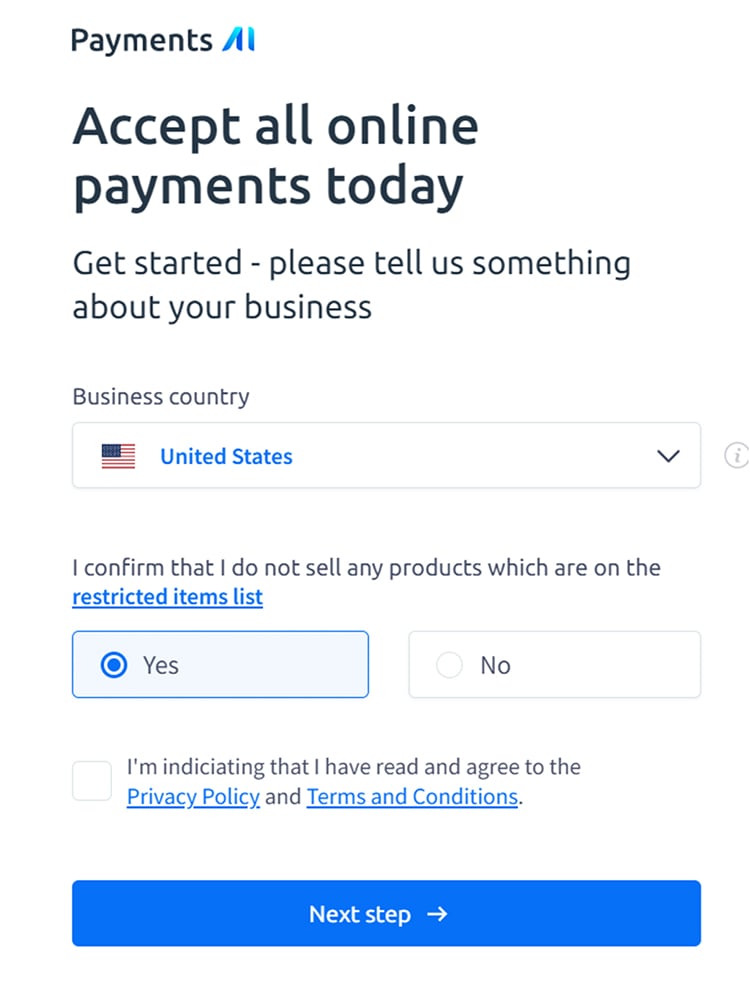

In your Funds.AI, you will get a snapshot of your enterprise’s monetary exercise.

You’ll be able to see issues equivalent to income collected, transactions, churn charge, and subscription metrics all at a look.

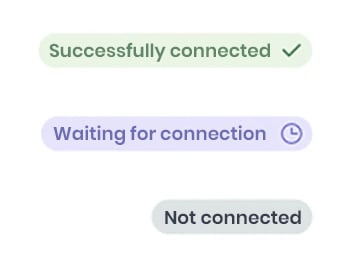

You may as well see which cost gateways you’ve related and are energetic in addition to any gateways which aren’t arrange or nonetheless require some data to complete connecting.

Notifications are additionally viewable in your dashboard. That is the place you’ll discover alerts equivalent to doc requests, payout alerts, and late invoice alerts.

Your dashboard can be the place you’ll navigate to different instruments and settings within Funds.AI. Within the subsequent part, we’ll stroll by a few of Funds.AI’s most necessary options.

Fundamental Options

To know what Funds.AI is able to, let’s stroll by the software program’s most basic options.

Fee Gateways

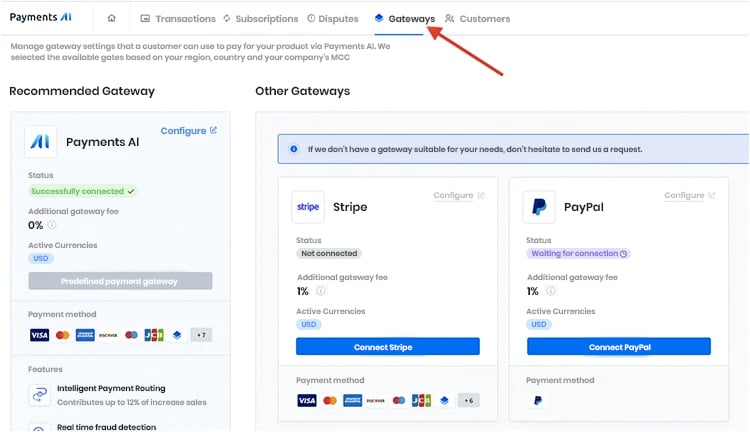

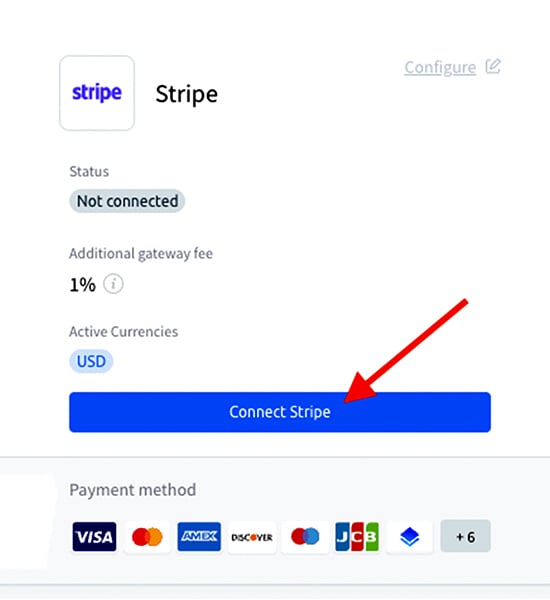

When you arrive at your dashboard, you possibly can arrange different cost gateways (equivalent to Stripe, Paypal, Coinbase, and Klarna) if you want. That is as straightforward as clicking on the “Gateways” tab.

Click on on the blue “Join” button after which log in when prompted and also you’ll be finished in a jiffy.

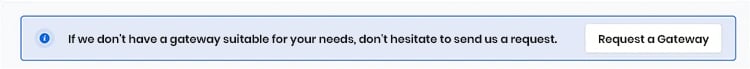

ClickFunnels 2.0 is new, so in case you’d wish to request a selected cost gateway that you simply haven’t seen, then you possibly can click on this button…

Along with including cost gateways, you may also customise some necessary settings for these gateways…

Sticky Gateway — By default, Funds.AI will break up your transactions 50/50 randomly between all of the cost gateways you may have arrange (you possibly can change this ratio globally for all gateways in Settings underneath “Gateway Automation Guidelines). Should you set a selected gateway to sticky, this can imply that the gateway “sticks” to clients whose first cost is processed by that gateway, making certain that buyer’s funds are at all times processed by the identical gateway.

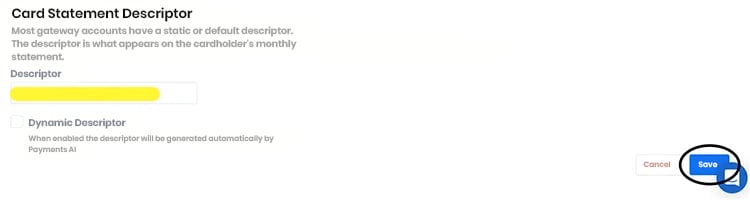

Card Assertion Descriptor — That is the place you possibly can change what’s proven in your clients’ bank card statements after they buy one thing from you.

3-D Safe — Enabling 3-D Safe will will let you course of funds utilizing cost playing cards protected with the 3-D Safe protocol. Most European cost playing cards require this protocol to be processed.

Transactions

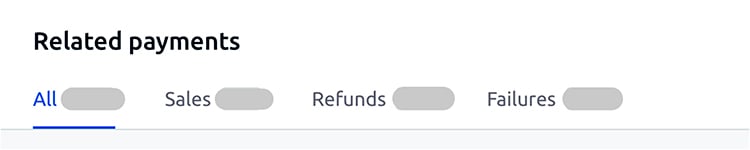

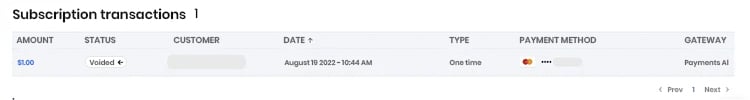

As with every good cost processor, you possibly can view a historical past of transactions which have come by all of your related cost gateways. Simply click on on the “Transactions” tab. You’ll be able to see gross sales, refunds, and the standing of every transaction.

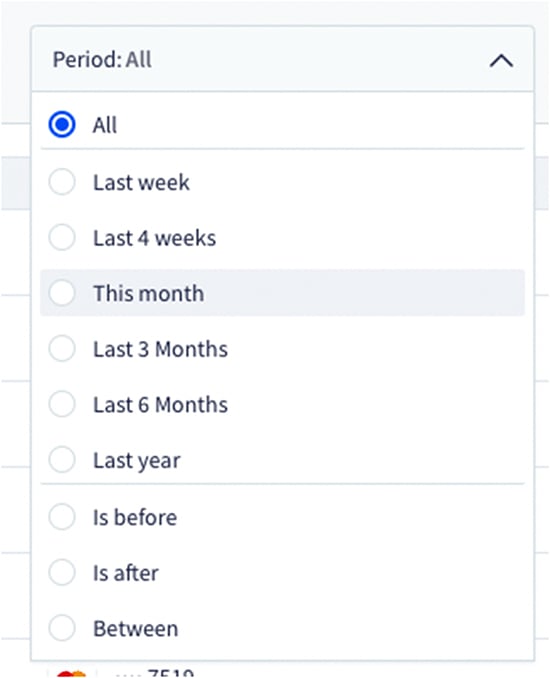

You may as well filter all of these transactions by time interval…

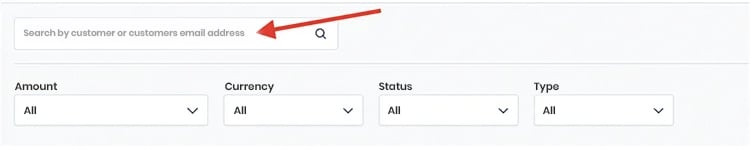

Lastly, you possibly can search by title or buyer e-mail in case you’re searching for a selected transaction…

Subscriptions

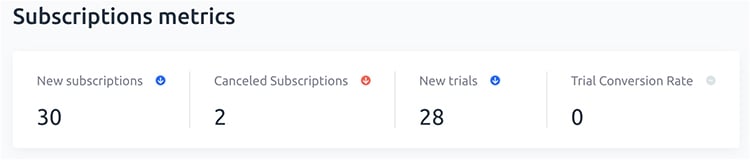

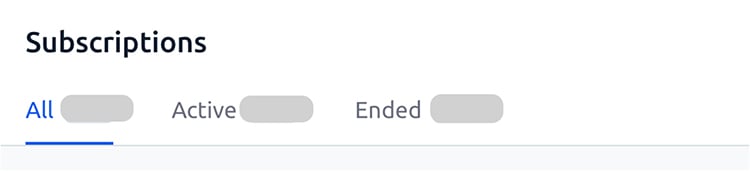

Just like transactions, you may also view your recurring subscription funds underneath the “Subscriptions” tab.

Right here you possibly can see funds, subscription clients, the date that every subscription began, cost schedules, and extra.

Prospects

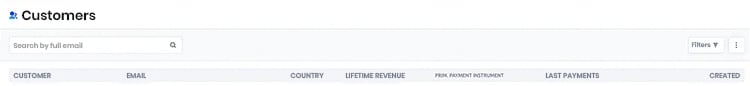

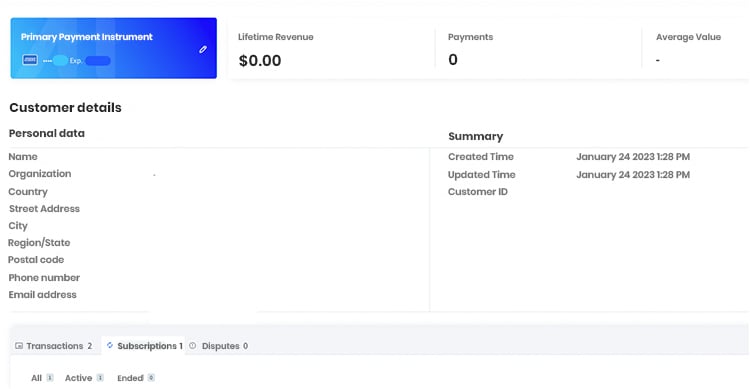

Underneath the “Prospects” tab, you’ll discover an exhaustive checklist of all the purchasers who’ve bought your services or products or have recurring subscriptions together with your firm.

At a look you possibly can see lifetime income, date created, final cost made, and a few fundamental buyer data.

You’ll be able to click on on every buyer to get extra detailed details about their relationship with your enterprise.

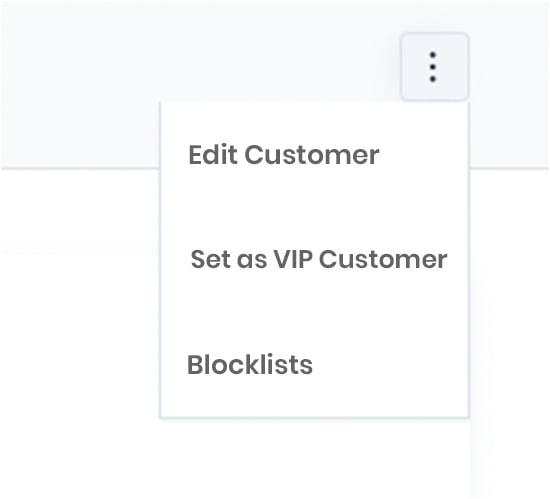

From the Prospects tab, you may also set particular clients to VIP…

What’s a VIP buyer?

A VIP buyer is one that you simply deem essential to your enterprise and might set completely different guidelines too, due to that. Additionally, when a buyer is about to a VIP buyer, they are going to be tagged each time you see their title so you’ll know they’re important.

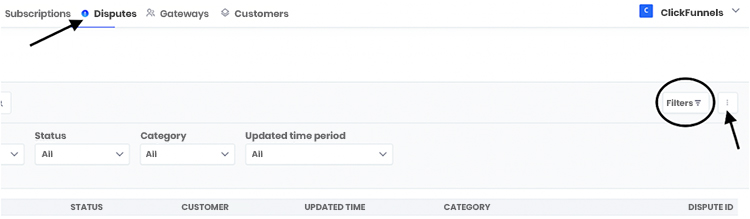

Disputes

Disputes aren’t any enjoyable.

However managing them is now a lot simpler due to Funds AI integration with Chargeback911.

This integration supplies full-service chargeback administration. With this service, Chargebacks911 decides which chargebacks to dispute and can submit all dispute documentation in your behalf.

Click on the Disputes tab from the highest menu. You’ll be able to filter by quantity, foreign money, standing, class, and time interval. You’ll be able to click on the three dots subsequent to filters to obtain or e-mail the info to a CSV:

Detailed reporting on all disputes can be out there to you from the Disputes tab on the highest menu bar. Right here it is possible for you to to observe the progress of your disputes.

As well as, you’ll obtain notifications of latest chargebacks in addition to standing updates within the Notifications part on the right-hand aspect of your dashboard.

IMPORTANT: Chargebacks are determined by the cardboard issuing financial institution and are decided by the principles and laws set by the cardboard cost model. Disputing a chargeback doesn’t assure and resolution in your favor.

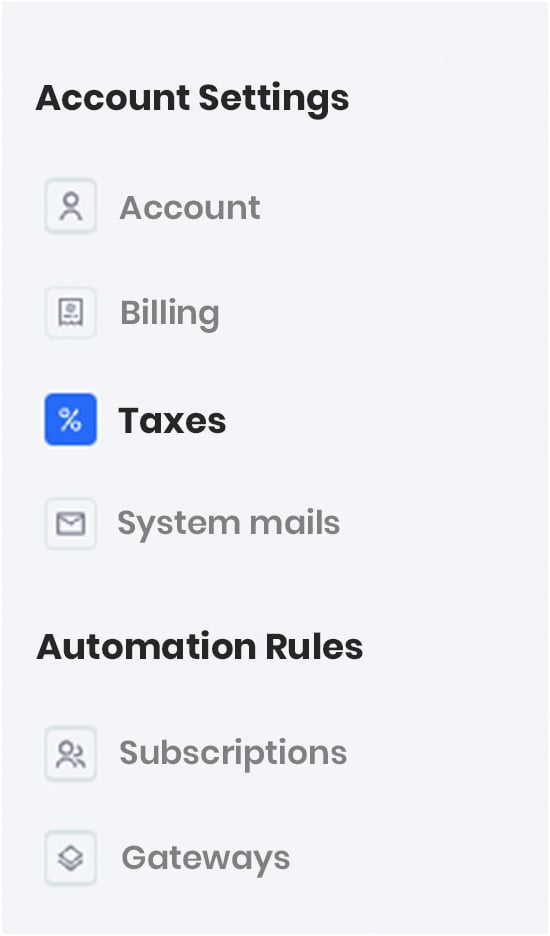

Tax Settings

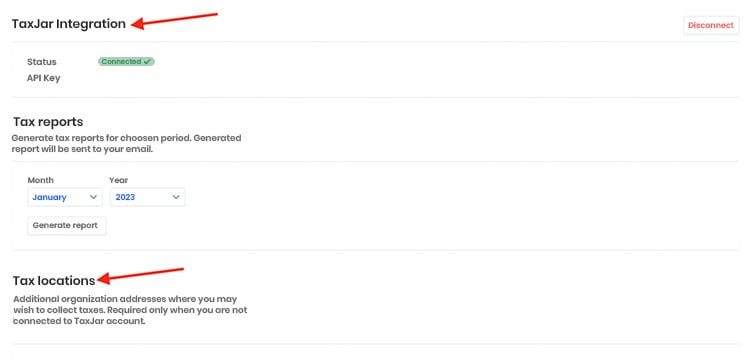

You’ll be able to customise tax settings to your Funds.AI account by going to settings and clicking on taxes.

Right here you possibly can join your TaxJar account you probably have one. If not, you possibly can set tax places your self manually. You may as well generate tax experiences from right here.

Gateway Experiences

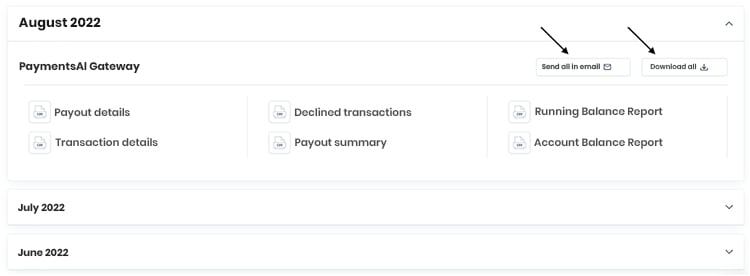

Gateway experiences can be utilized to help with the reconciliation of your transactions together with your checking account every day or to search for particulars on transactions. These experiences could be downloaded or emailed.

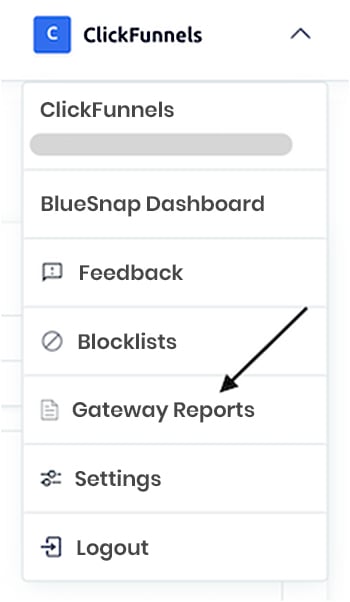

To entry these experiences, please choose Gateway Experiences from the drop-down menu within the higher right-hand nook of the display screen:

From right here, you possibly can increase the month you wish to pull the experiences for. To acquire all of the experiences without delay, you need to use the buttons for Ship all in e-mail or Obtain all:

You may as well e-mail or obtain a person report by hovering over the report you need and utilizing the envelope icon to e-mail and the down arrow icon to obtain:

Here’s a description of the experiences you possibly can entry from this web page:

Payout Particulars – Retrieving transaction-level payout particulars is useful when reconciling the processing charges charged by Funds AI with the transactions you processed.

Transaction Particulars – Get hold of detailed data, equivalent to shopper and cost information, about your sale, refund, and chargeback transactions.

Declined Transactions – Get hold of particulars about every card transaction declined by the issuing financial institution, together with the date, decline cause, transaction quantity, and shopper information. This data is useful when you have to attain out to consumers with declined funds.

Payout Abstract – Retrieving transaction-level payout particulars is useful when reconciling the processing charges charged by Funds AI with the transactions you processed.

Working Steadiness Report– See your stability in real-time, in addition to affecting occasions.

Account Steadiness Report – Reveals a abstract of your account stability together with any payout changes in addition to the quantity you may have in reserves.

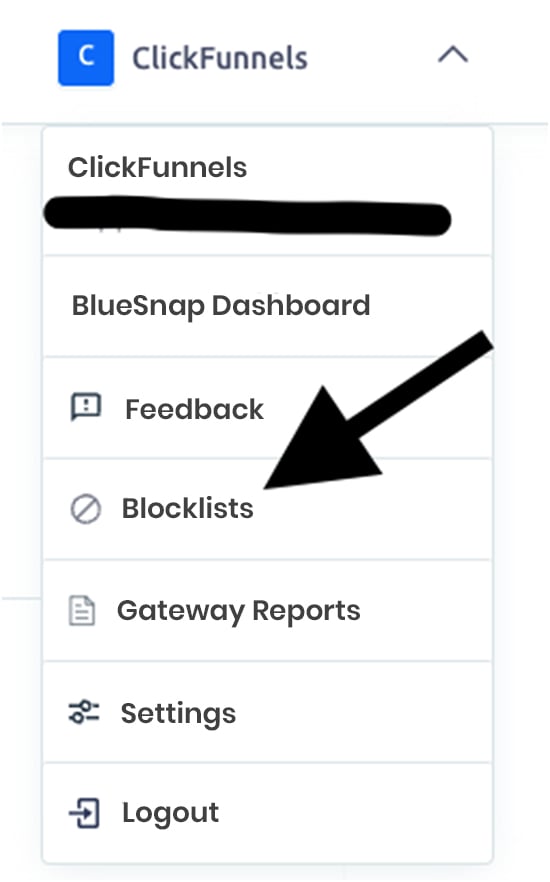

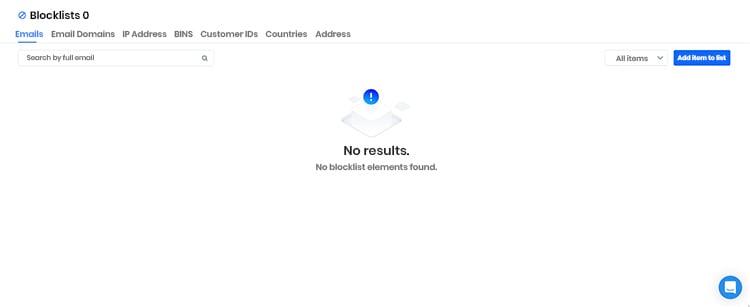

Blocklists

You would possibly wish to often block sure e-mail addresses or clients from buying your services or products. In that case, you possibly can add these accounts to your “blocklist” within your Funds.AI account.

To view, handle or add to your Blocklists, click on the title of your organization within the high proper of the display screen. From the drop-down menu, click on Blocklists:

From right here, you possibly can click on the blue button, Add an merchandise to the checklist to dam transactions from sure e-mail addresses, e-mail domains, IP addresses, Financial institution ID numbers, Buyer IDs, Nations, and bodily addresses.

You may as well use the field supplied to go looking by any of these standards to see if the shopper is already on a specific blocklist and in addition filter by energetic or expired:

Alternatively, you may also add somebody to a blocklist from the Prospects Tab.

Funds.AI Professional Options: Rule Setting & Automations

If you wish to use some superior automation options, you possibly can activate Funds.AI PRO and get entry to the next options…

Subscriptions — This can will let you create recurring subscriptions. It prices an extra 0.5%/recurring transaction.

Automation Guidelines — This function means that you can create automations for subscription dunning, trial finish reminders, and bank card expiration reminders. You may as well create guidelines and automations indicating if you wish to use which cost gateways (equivalent to setting cost gateways primarily based on the shopper’s nation). It prices an extra 0.5%/recurring transaction. Try the principles & automations you possibly can create beneath…

- Trial Finish Reminder — Robotically ship an e-mail to the shopper whose subscription trial interval is ending. Select the variety of reminders and when to ship them. Default settings will ship one reminder seven days earlier than the trial ends. If the trial length is lower than seven days, we ship the e-mail instantly.

- Credit score Card Expiration Reminder — Robotically ship an e-mail to a consumer whose cost card is about to run out. Select the quantity of reminders and when to ship them.

- Subscription Dunning — This lets you customise how Fee.AI treats failed cost makes an attempt. You’ll be able to inform Fee.AI when to retry a subscription and what number of instances. You may as well point out what you need Fee.AI to do if the cost continues to fail.

Bundle Subscription & Automation Guidelines — This lets you get entry to subscriptions and automation guidelines with out being double charged the 0.5% for every transaction. You should utilize each options and we’ll solely cost the 0.5% charge as soon as per transaction.

Funds.AI Pricing Defined

You would possibly discover that in case you’re utilizing the Funds.AI gateway, you’re charged a 0% gateway charge whereas in case you use a third-party gateway you’re charged a 1% gateway charge.

This is the reason it might probably prevent a bit of cash to make use of the Funds.AI gateway.

To be clear, the gateway charge is separate and distinct from the transaction charges.

Gateway charges are utilized to cowl the prices of receiving and processing a transaction. This charge pays for the usage of the software program infrastructure to acquire cost data, request authorization from the patron’s financial institution, and to facilitate the cost from one entity to a different. Funds AI means that you can use a number of gateways in the identical service provider account to guard you because the entrepreneur from ever having any cost stoppages in your pages or funnels. That is the place you will note the gateway charge utilized for third-party gateways to proceed providing this service to our customers.

Transaction charges are for the comfort of accepting bank card funds charged by the completely different card networks and processors. These are charged by Funds.AI in addition to different cost processors.

You’ll be able to see a breakdown of pricing between all of the completely different cost gateways right here.

Closing Ideas

As you possibly can see, Funds.AI has a ton of cool options and instruments that can make the nitty-gritty cost processing occasion of your enterprise stream easily and seamlessly.

Hopefully, this information has given you a greater concept of how you need to use Funds.AI to handle your enterprise and create some helpful automation guidelines.

The following step is to get arrange and take a look at it out for your self.

Go to your ClickFunnels 2.0 account and comply with the steps above!

Have extra questions? Attain our help group by contacting us at help@funds.ai.