Profitability is a key measure of an organization’s success, particularly for startups. Traders need to know if an organization’s core actions can lead to a revenue, so that you’ll must know and perceive your organization’s working earnings.

Roughly 20% of small companies fail of their first yr of enterprise. Whereas changing into worthwhile in your first yr of enterprise is difficult, in case you are worthwhile, it is a constructive indicator that your organization is on the right track.

However how can we calculate profitability? It’s not as laborious as you would possibly suppose. Discover out under.

What is working earnings?

Working earnings is a measure of an organization’s profitability. Mainly, it’s the revenue left over after bills are taken away from a firm’s income. It is calculated by subtracting working bills from working income.

The ensuing quantity is proven as a subtotal on an organization’s multi-step earnings assertion. Working earnings is often known as working revenue, working earnings, or earnings from operations.

Collectors and traders take a cautious have a look at an organization’s working earnings. This quantity offers them a clearer image of the enterprise’ scalability or capability for future progress.

For instance, a constructive working earnings reveals there’s room for the corporate to develop in its business. In the meantime, a detrimental working revenue may imply the enterprise is much less prone to scale up and develop.

Now that we’ve discovered what working earnings is, let’s take a deeper look into the main points and study the steps to calculate your enterprise’ working earnings.

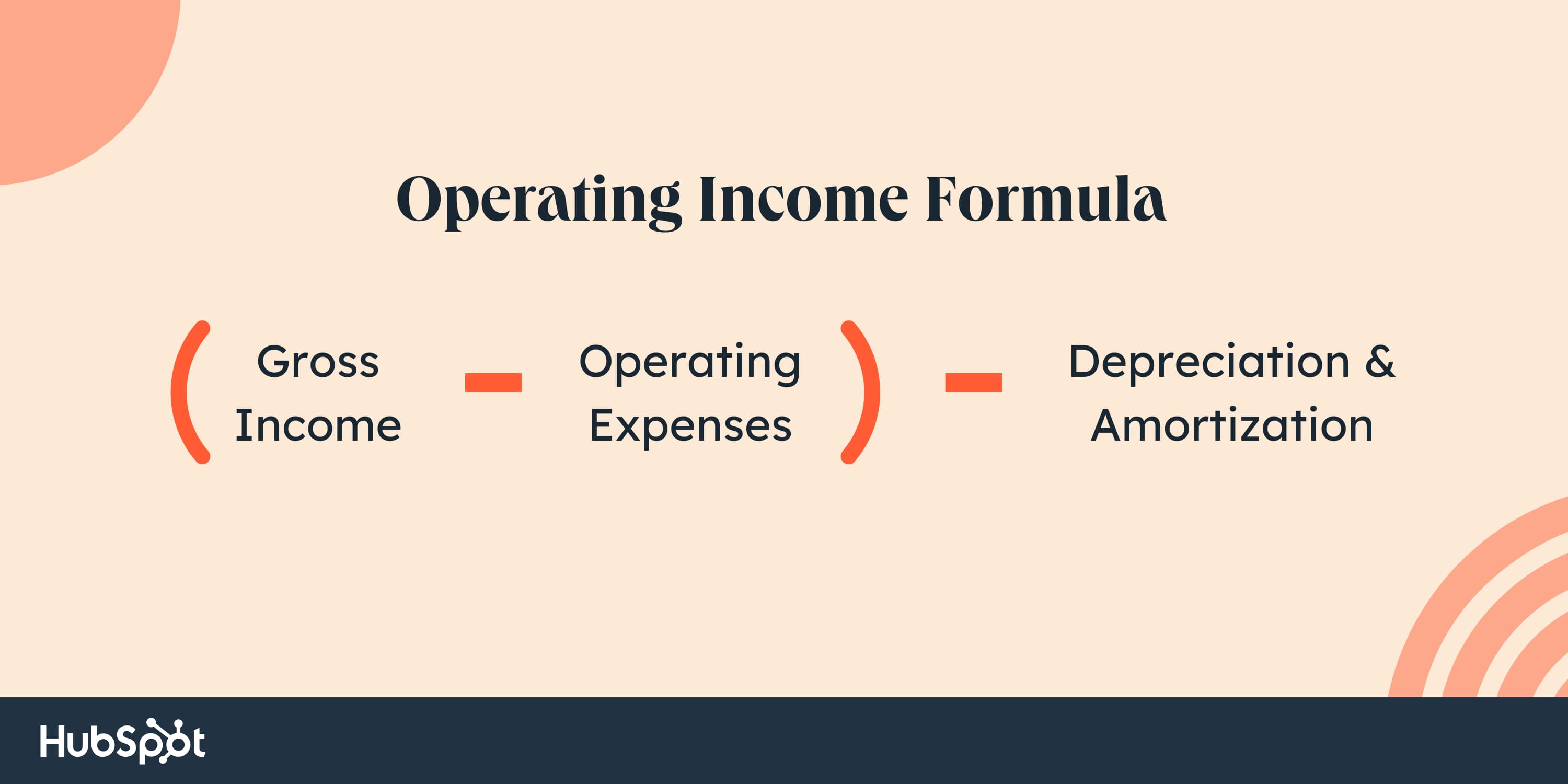

Working Revenue Method

- Begin with gross earnings.

- Subtract working bills.

- Subtract depreciation and amortization.

- The ensuing quantity is working earnings.

Let’s outline a number of key items of the working earnings components.

1. Gross Revenue

Gross earnings is the sum of money your enterprise earns earlier than any taxes or different deductions are subtracted from it.

Lenders use this quantity as an indicator of how a lot cash you’re prone to borrow. They typically ensure you don’t borrow greater than your gross earnings whole.

2. Working Bills

That is the mixed whole of the prices of working your core enterprise actions. Frequent working bills embrace:

- Lease.

- Utilities.

- Value of provides.

- Wages.

- Gross sales commissions.

- Insurance coverage.

- Authorized charges.

- Value of products offered (COGS).

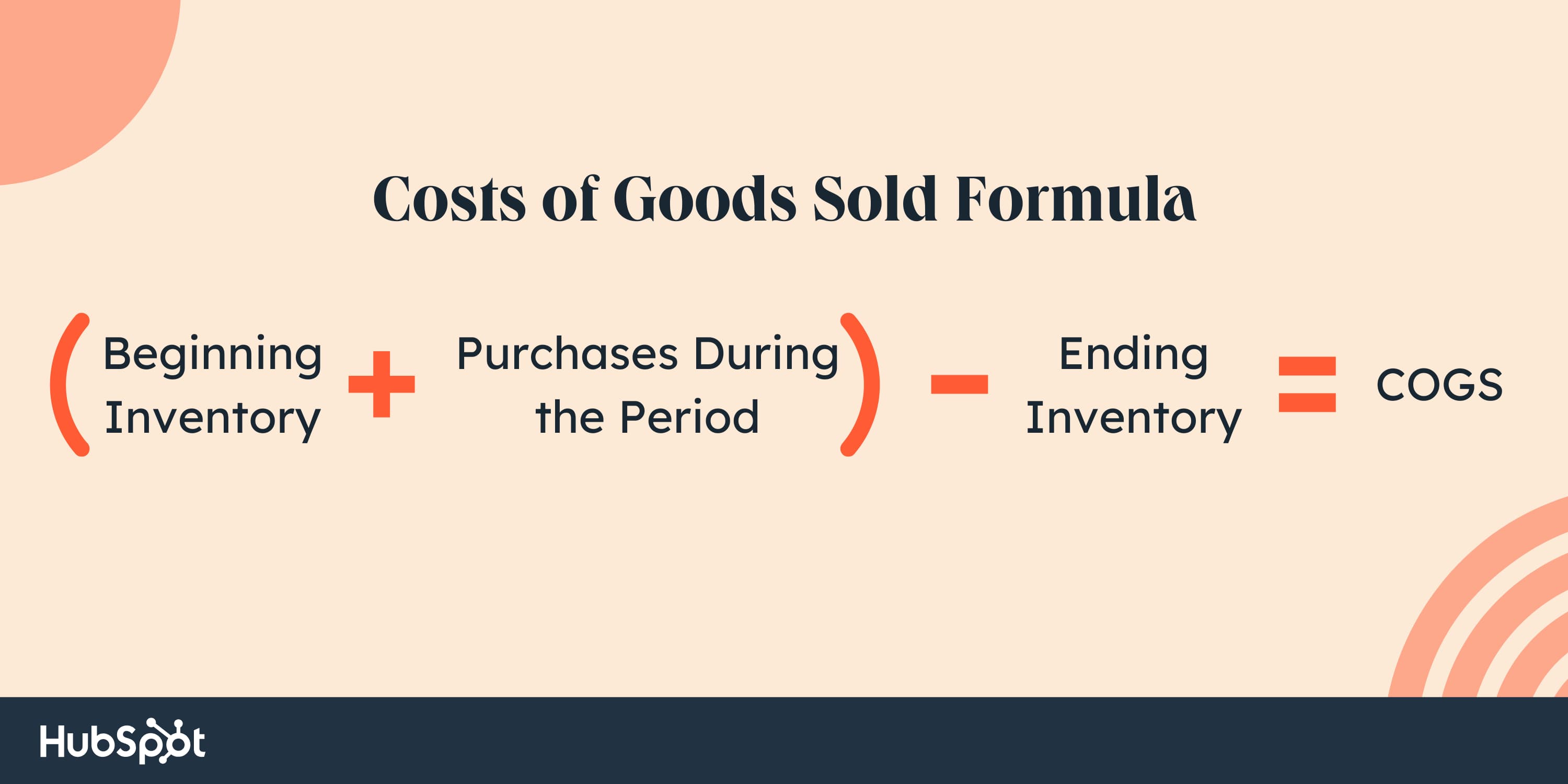

One key element of working bills is COGS. Beneath is the components for COGS:

Starting stock is the merchandise that wasn’t offered within the earlier yr. Purchases in the course of the interval embrace the price of producing extra merchandise or shopping for extra merchandise.

On the finish of the yr, the unsold merchandise (ending stock) are subtracted from the sum of the start stock and purchases in the course of the interval.

3. Depreciation and Amortization

Depreciation and amortization are bills that account for the price of belongings over the lifetime of their use. These numbers are discovered within the working expense part of the earnings assertion and are reported in the course of the interval of every asset’s use.

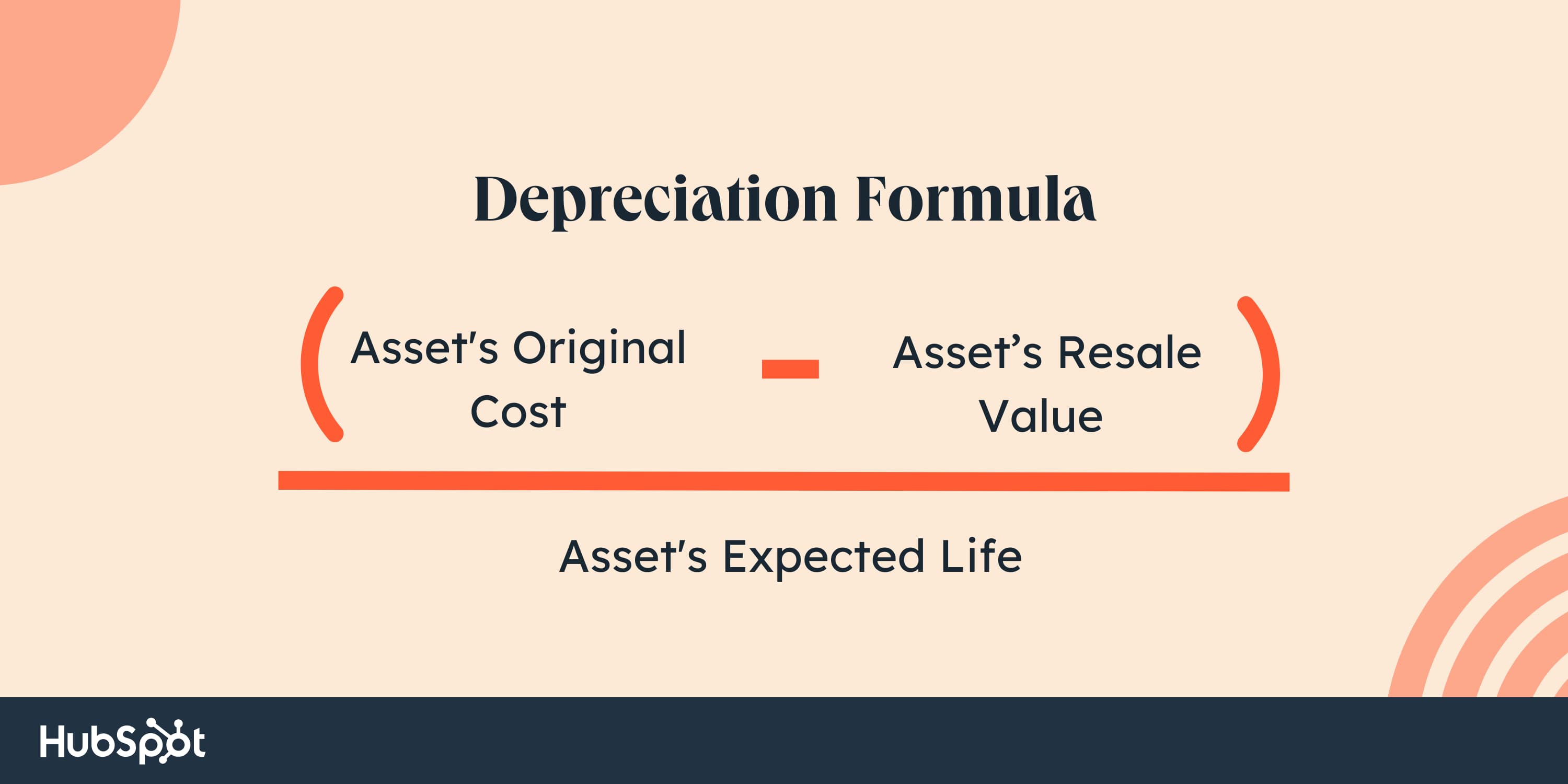

Depreciation entails expensing of tangible belongings over their helpful life. Tangible belongings, or fastened belongings, are bodily belongings corresponding to buildings, autos, tools, workplace furnishings, and many others.

Depreciation is calculated by subtracting the asset’s resale worth from its authentic price — and that is expensed over the course of the asset’s anticipated life.

For instance, if a enterprise buys a machine that prices $10,000, the enterprise bills the fee over the machine’s 10-year lifespan. The resale worth after 10 years is $2,000. The depreciation calculation would appear like this:

($10,000 – $2,000) / 10 years = $800

The corporate will expense $800 every year till the machine is totally paid off within the tenth yr.

Amortization is just like depreciation, besides it entails expensing of intangible belongings.

Examples of intangible belongings embrace logos and patents, copyrights, franchise agreements, and many others. In contrast to tangible belongings, these intangible belongings sometimes don’t have any resale worth on the finish of their life.

Working Revenue Examples

Let’s have a look at a number of examples of working earnings.

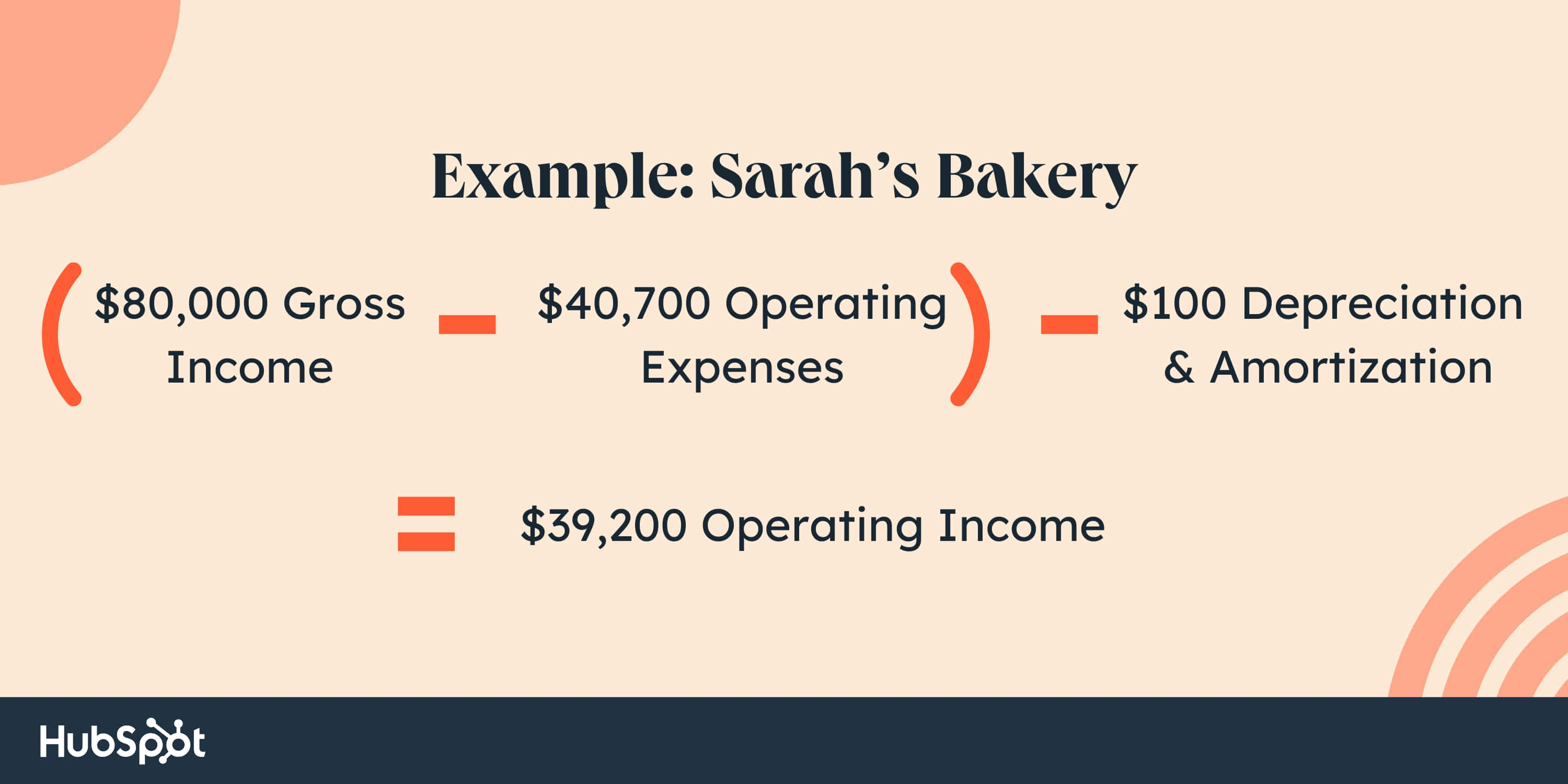

Instance 1: Sarah’s Bakery

Sarah’s Bakery makes a speciality of creating wedding ceremony truffles for {couples} within the Boston space. Her small enterprise is rising and she or he desires to maneuver her operations to a much bigger location and buy a brand new house. Earlier than she will transfer her enterprise, she must borrow cash from the financial institution.

She creates a multi-step earnings assertion to indicate the financial institution how properly her core enterprise is doing. Over the course of the yr, Sarah offered $80,000 value of wedding ceremony truffles. She additionally had the next bills:

- Lease: $24,000

- Utilities: $5,000

- Insurance coverage: $1,000

- Baking provides: $10,000

- Tools: $700

- Depreciation and amortization: $100

Right here’s how Sarah calculated her working earnings

With a constructive working earnings of $39,200, Sarah can present the financial institution she’s been in a position to generate a revenue together with her enterprise. This will increase the probability she’ll get a mortgage to assist pay for the price of buying the brand new location.

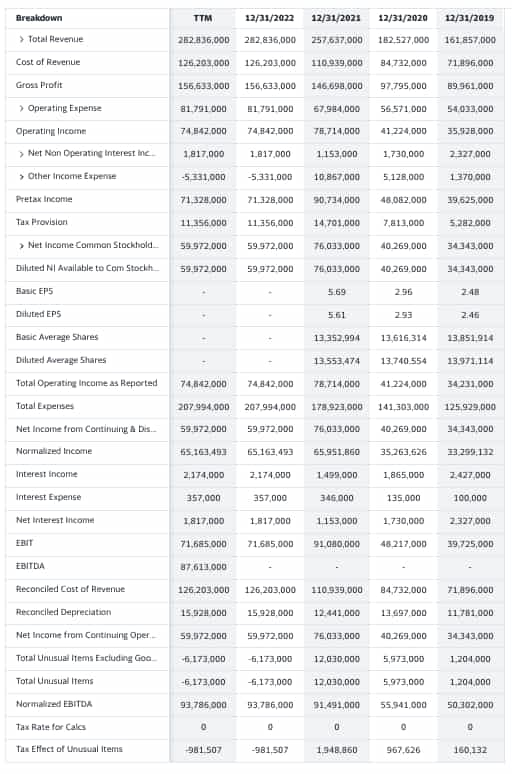

Instance 2: Google

To get an concept of what this appears like, right here’s an instance of Google’s earnings assertion over the previous few years, together with working earnings.

We are able to see that Google has maintained a constructive working earnings over the previous 4 years. This widespread search engine’s excessive working earnings is a sign of its profitability.

Understanding Your Working Revenue

With the working earnings and different measures of your enterprise’ money flows and monetary standing, you may gauge your enterprise’ potential to usher in a revenue. The upper the working earnings, the extra worthwhile the corporate’s core enterprise is.