This week we’re going to speak about money stream statements. I discover money stream statements to be probably the most complicated and complex of the three key monetary statements. Subsequently I’m going to do my greatest to maintain it easy.

The Distinction Between Money Circulate and PNL

In the long run, money stream statements are to designed to offer perception into the “money” transferring out and in of the enterprise. At first look it’s straightforward to suppose we already know this. We’ve seen the P&L assertion. We all know how a lot the corporate made. The issue with that’s, the P&L assertion solely addresses what’s “owed” or “earned” not essentially the money transaction. It’s attainable for a extremely worthwhile firm to be tight on money. An instance of it is a cell phone supplier. Cellular carriers have very excessive capital prices to construct on the market networks. Capital prices don’t present up on the P&L Statements.

They’re depreciated as an expense additional time. Subsequently a billion greenback money out lay received’t be seen as a billion greenback expense merchandise on the P&L. The service may very well be exhibiting a revenue, however be money stream destructive. The opposite aspect of that coin may very well be service firm that prices for a 12 months of it’s providers up entrance. The service firm would get a lump sum of money in let’s say January, however can solely acknowledged the income month-to-month. Subsequently they may very well be money stream optimistic within the month they acquired the money, however may very well be dropping cash.

How you can Calculate Money Circulate

Accounting for money stream isn’t easy. Calculating money stream is less complicated so we’ll begin their. To calculate money stream, merely examine money in the beginning of the 12 months (or time interval you wish to measure) from the top of the 12 months and you’ve got money stream. For instance, should you start the 12 months with 10 million {dollars} in money and ended the 12 months with 6 million {dollars} in money, you’re money stream destructive by 4 million {dollars}. In case your money steadiness on the finish of the 12 months is 12 million {dollars}, your money stream is optimistic by 2 million {dollars}.

As I stated, accounting for money stream will get just a little extra furry however I’ll do my greatest to spell it out.

Items of Money Circulate Statements

The very first thing to note is money can come from three key areas, working actions, investing actions and financing actions.

Working actions is money spent or generated by means of the operations of the enterprise, this contains money from items and providers bought, funds to suppliers, loans bought, curiosity on loans and so forth.

Investing actions contains, money acquired from or spent on the sale of belongings, loans made or acquired, or money spent and acquired from mergers and acquisitions.

Financing actions embody, money from traders reminiscent of VCs and shareholders in addition to outflows of money within the type of dividends.

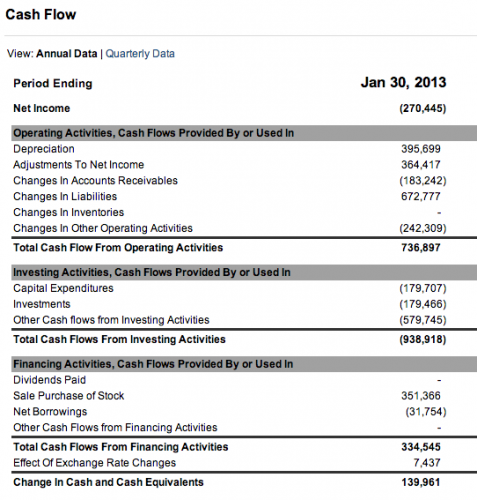

To remain according to the Stability Sheet and P&L posts we’ll have a look at Salesforce’s money stream assertion.

Working Actions

Discover the working class, Salesforce is producing a pleasant chunk of money from operations, over 700 million {dollars}. That’s 30% of whole income and working revenue.

Investing Actions

Now lets have a look at the investing class. Salesforce has used nearly a billion {dollars} of money in investing. On this class they’re money stream destructive. A 179 million of the money was in capital bills. I’m going to imagine that is primarily for {hardware}, servers, community infrastructure and so forth. Capital bills are thought-about investments within the firm and that’s why they present up within the investments class of the money stream assertion.

Past capital expenditures, Salesforce used money in outdoors investments to the tune of greater than 750 million. I don’t know the way Salesforce is dividing “investments” from “different money flows from funding actions” however we do know that Salesforce has been on an acquisition spree over the previous few years and it may have one thing to do with M&A and debt.

Financing Actions

Lastly, we will have a look at the financing actions a part of the money stream assertion. Right here we see Salesforce has generated over 335 million in money from financing actions, largely from it’s inventory.

On the finish of 2013, Salesforce is money stream optimistic to the tune of just below 140 million {dollars}.

Why does money stream matter?

In the event you bear in mind within the Stability Sheet publish, I say money is king. Money is what retains a enterprise going. In the event you run out of money, sport over, except you will get somebody to finance you. However, that’s by no means a very good signal. Subsequently, realizing if an organization is producing money, and the place it’s coming from OR the place it’s going OUT is vital.

WITCE (What’s the Buyer Expertise) Money Circulate Assertion Questions

- Is the client money stream optimistic or destructive?

- How does what you promote have an effect on money stream?

- Does what you promote probably enhance money stream; accounts receivables, inventories and so forth?

- How does the shoppers money stream impression your deal technique?

- Does it matter should you prospects or prospects are money stream optimistic or destructive?

- Do you account for a corporations money stream well being in your prospecting and gross sales course of?

- Can you discover alternatives to promote your services or products by reviewing a prospects or prospects money stream assertion?

We’ve now lined the three most important monetary statements. The secret is to have a look at them in tandem. By all of them on the identical time may give you some actual perception into who you’re promoting to, their monetary well being and most significantly potential information to enhance your deal technique or create new alternatives.

I hope you bought one thing out of those three posts and located them informative. Unsure what’s up for subsequent WITCE Wednesday, however I’m liking this sequence to this point, so I’m going to maintain going for awhile.

If there’s a subject you’d like me to cowl, let me know.