I am happy with how the portfolio has formed up over the past couple weeks. Of our 8 present positions, 6 are winners, one is breaking even, and one is a small loser. A number of of the shares have been in an uptrend as nicely. In the meanwhile, we will (possible) deal with smaller adjustments reminiscent of trimming or including to positions. We’re at about 70% allocation of our money, which I believe is affordable on this atmosphere. Issues can change in a rush in fact, however I am content material with the combo of shares now we have within the portfolio right now. Let’s check out what is going on on within the S&P 500 (SPY) week. Learn on for extra….

(Please get pleasure from this up to date model of my weekly commentary initially printed June 8th within the POWR Shares Beneath $10 e-newsletter).

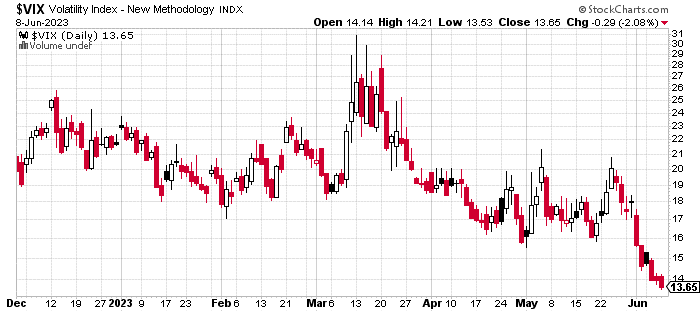

Market volatility has actually come crashing down for the reason that debt ceiling scare ended with hardly a whimper. We’re seemingly experiencing the summer time buying and selling doldrums, the place not a lot occurs within the inventory market from a macro perspective.

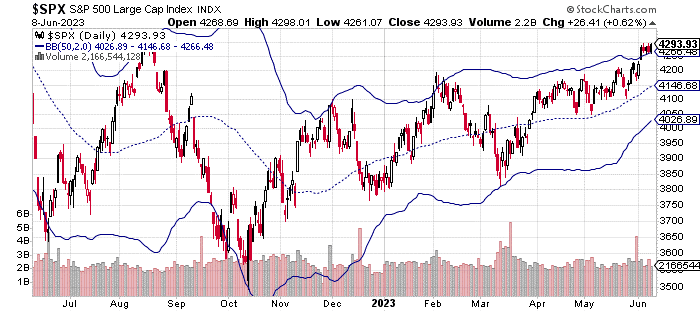

You’ll be able to see within the chart above, the SPX (S&P 500 index) has breached the two-standard deviation higher barrier.

That does not essentially imply shares are going to dump because the bands are fairly slim as a result of a decrease volatility atmosphere. Nevertheless, imply reversion is a undoubtedly risk within the coming days (simply because of the regulation of averages).

Whether or not the market stays on this low volatility atmosphere will principally be decided by what the Fed says and does on the June and July FOMC conferences.

We’ve the June assembly coming subsequent week after which it will not be a shock to see an entire lot of nothing within the markets till after Independence Day.

The market continues to foretell a pause in fee hikes for June. The futures market exhibits a 72.5% likelihood of the Fed doing nothing to charges subsequent week.

Financial information has been combined to the purpose the place the Fed can possible justify not rising charges (straight). After all, they will accomplish a few of their objectives by jawboning (e.g. speaking down the market).

In July, futures are exhibiting a roughly 65% likelihood of a fee enhance. That tracks with the mainstream narrative.

It has turn into obvious that the Fed is not carried out elevating charges. Nevertheless, at this stage, they are not in as a lot of a rush to hike.

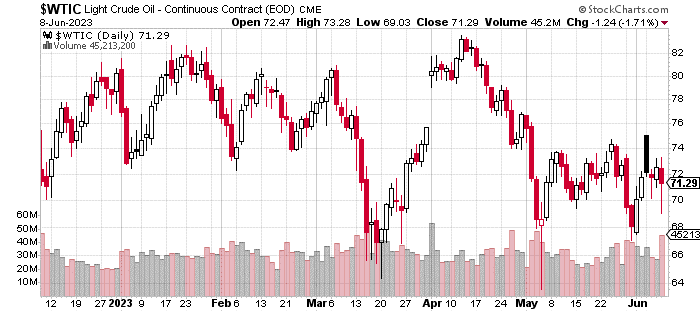

Transferring on to grease, West Texas crude has been a bit unstable recently. Saudi Arabia introduced manufacturing cuts, and the value of crude briefly spiked. Nevertheless, it is come again right down to round $70 per barrel.

Keep watch over oil because it could possibly be a number one indicator for the economic system (and thus, shares). A worth too excessive or too low is usually not good for shares (for various causes). Nevertheless, the place we are actually by way of worth is just about a non-factor.

As talked about earlier, volatility, as seen within the VIX chart under, has come crashing down in current days. The value is now firmly under 15, which is usually thought of a low-volatility regime.

Whereas we may see a short-term spike based mostly on the information cycle or the Fed, I count on volatility to stay comparatively low.

The summer time months are usually slower by way of realized volatility (the precise motion of shares). Thus, implied volatility (ahead trying) tends to return down as nicely. That is no less than a part of why the VIX is so low proper now.

Let’s check out the portfolio.

What To Do Subsequent?

The above commentary will aid you respect the place the market goes. However if you wish to know the very best shares to purchase now, then please try my new particular report:

3 Shares to DOUBLE This 12 months

What offers these shares the appropriate stuff to turn into massive winners, even on this difficult inventory market?

First, as a result of they’re all low priced corporations with essentially the most upside potential in as we speak’s unstable markets.

However much more vital, is that they’re all high Purchase rated shares in keeping with our coveted POWR Scores system and so they excel in key areas of development, sentiment and momentum.

Click on under now to see these 3 thrilling shares which may double or extra within the yr forward.

3 Shares to DOUBLE This 12 months

All of the Finest!

Jay Soloff

Chief Progress Strategist, StockNews

Editor, POWR Shares Beneath $10 Publication

SPY shares rose $0.19 (+0.04%) in after-hours buying and selling Friday. 12 months-to-date, SPY has gained 12.84%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Jay Soloff

Jay is the lead Choices Portfolio Supervisor at Buyers Alley. He’s the editor of Choices Flooring Dealer PRO, an funding advisory bringing you skilled choices buying and selling methods. Jay was previously knowledgeable choices market maker on the ground of the CBOE and has been buying and selling choices for over 20 years.

The put up How Decrease Volatility and Oil Manufacturing Cuts Might Impression the Market… appeared first on StockNews.com