The statistics are bleak, however need to be repeated. 90% of startups fail, in keeping with an in-depth evaluation of three,200 firms as a part of the Startup Genome Report. The researchers blame “untimely scaling” as the foundation trigger, declaring that 70% of startups within the research scaled earlier than they had been prepared and that startup founders considerably underestimate how lengthy it takes to validate their market.

It’s no surprise that the startup group obsesses over discovering product-market match. In any case, product-market match is a crucial prerequisite to with the ability to scale in a fashion that creates long-term worth for shareholders.

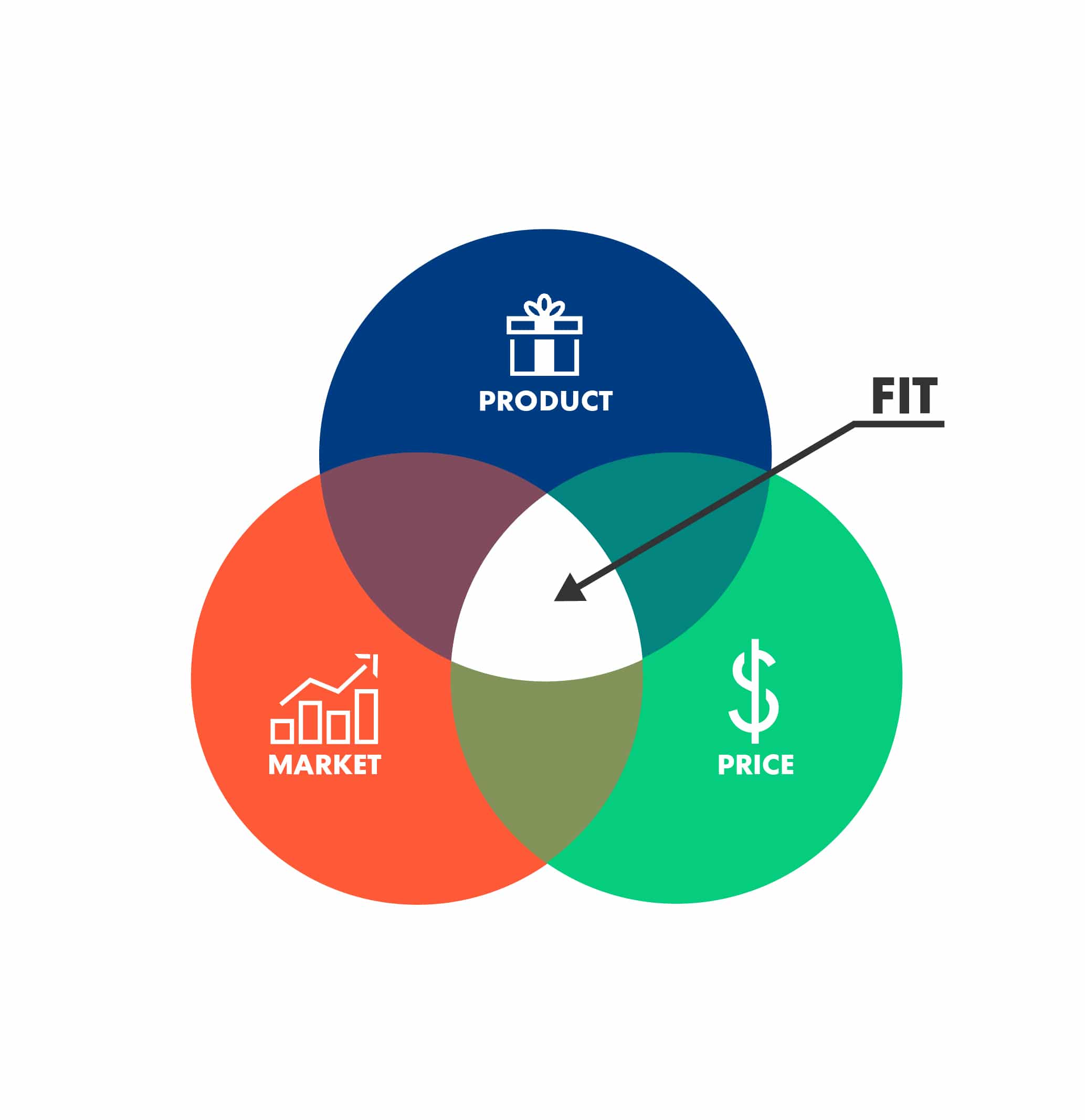

For the uninitiated, product-market match will be understood as situations when a startup introduces a brand new product that meets an actual buyer want, does so in a manner that’s higher than alternate options and in a market that may assist a standalone enterprise. Product-market match tends to be a spectrum quite than a discrete, huge bang occasion and it sometimes takes continued, sustained effort to enhance it over time (e.g. by extending the market alternative, creating extra aggressive differentiation, discovering decrease price methods to accumulate clients).

Sadly, the entire give attention to product-market match glosses over an idea that’s equally as necessary to a startup’s success: pricing.

Product-market-price match

First Spherical Capital not too long ago investigated the most typical errors made by startup founders who battle to fundraise. In comparison with friends who breezed by way of the fundraising course of, those that struggled had been:

-

-

- 3x extra prone to say they monetized too late

- 2x extra prone to pursue the unsuitable enterprise mannequin

- 1.4x extra prone to say they botched their go-to-market technique

-

Actually, we are able to agree that choosing the right go-to-market technique is part of discovering product-market match. However, deciding when to monetize and which enterprise mannequin to pursue appear disconnected, but are clearly basic to a startup’s success.

I suggest we reframe product-market match to product-market-price match. Right here’s my working definition:

Product-market-price match refers to situations when a startup provides a brand new product that meets an actual want that clients pays for at a value that may assist a standalone enterprise.

The value ingredient of product-market-price match speaks to a couple completely different components that underpin a startup’s capability to scale: their pricing energy available in the market, the attractiveness of their pricing mannequin and the well being of their unit economics.

First, a startup ought to have indicators of pricing energy. Pricing energy is interconnected with each the product (i.e. the product is so good that individuals pays a good value for it) and the market (i.e. the variety of potential customers multiplied by the typical value equals a market massive sufficient that it’s price pursuing). If the one purpose why a startup wins offers is as a result of they’ve the bottom value available in the market, I might be extremely skeptical that they’ve discovered product-market-price match, until they’ve discovered a radically creative technique to minimize prices out of the enterprise. But when a startup can elevate costs and prospects don’t balk, then it’s a transparent signal that the product has substantial product-market-price match and there’s room to take a position extra in scaling the enterprise.

Discovering the correct pricing mannequin

Startups must discover a pricing mannequin that permits them to extract worth out of what they’ve constructed from their goal buyer. Within the age of SaaS and ubiquitous subscriptions, this will likely sound like a bit of cake. However subscriptions aren’t the one recreation on the town, as I’ve written about beforehand.

Reality be advised, SaaS startups now have almost limitless pricing mannequin choices at their disposal. They might go for completely different flavors of free (freemium, free trial, free merchandise), completely different worth metrics (seat-based pricing, usage-based pricing, limitless plans) and completely different pricing buildings (two-part tariffs, three-part tariff, pay as you go). No matter mannequin they select should, at a minimal, cowl their prices and enchantment to potential clients. Even higher, the pricing mannequin may grow to be a disruptive supply of aggressive benefit, additional signaling {that a} startup is able to scale.

Logikcull, a authorized tech startup that gives cloud discovery software program, discovered that just about two-thirds of attorneys work at legislation companies with 5 or much less attorneys. These companies balk on the concept of a pre-paid annual subscription, an perception that led Logikcull to introduce a disruptive no-commitment, pay as you go possibility.

Lastly, pricing must allow a go-to-market technique with wholesome unit economics. If a startup expenses too little, they gained’t have the sources to assist investing in paid advertising or costly gross sales sources, a phenomenon often known as being too hungry to eat. Low costs may appeal to too lots of the unsuitable clients, those that initially convert however don’t stick round. This once more ends in an LTV:CAC ratio that isn’t sturdy sufficient to spend money on development.

It’s time for the startup group to raise the position that pricing performs in constructing a steady basis on which to scale. Pricing shouldn’t be an after-thought as soon as a startup reaches product-market match. It ought to as a substitute be a key space of focus and experimentation within the early levels of a startup’s lifecycle. Let’s transfer from product-market match to product-market-price match.