A brand new report from a court-appointed Monitor suggests Monetary Training Companies’ compliance efforts are on target.

A brand new report from a court-appointed Monitor suggests Monetary Training Companies’ compliance efforts are on target.

The FES Monitor filed his first report final November. Within the report, which centered closely on FES’ ongoing compliance efforts, the Monitor claimed “extra might be completed”.

In a second report filed on April twenty seventh, the Monitor continues to trace FES’ compliance efforts.

The Monitor believes the Monitored Entities have modified their company tradition to “striving to do the best factor,” from the obvious pre-Grievance place of “having the best issues nominally in place so we will level to these if somebody challenges us.”

That mentioned, the Monitor stays involved that the Monitored Entities both don’t totally embrace or comprehend what compliance entails.

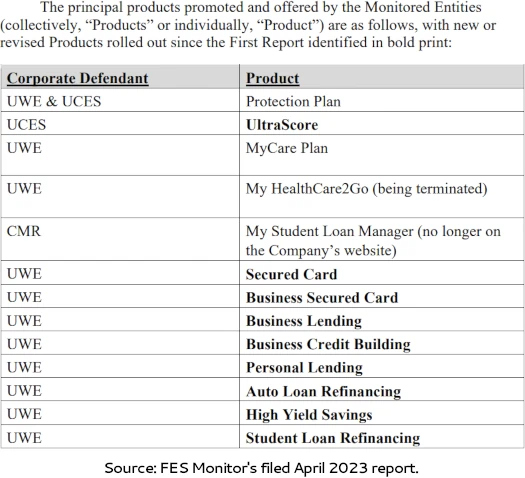

A major instance of that is FES’ newly launched merchandise.

The Firm launched new Fintech Merchandise apparently with none advance consciousness, complete authorized identification or assessment of potential regulatory points.

It seems the Firm started providing these Fintech Merchandise to fulfill promptly agent wants within the market so as to match choices by rivals.

However, the Firm evidently by no means sought authorized recommendation on the regulatory implications of those Fintech Merchandise nor on how to make sure full regulatory compliance till shortly previous to saying them publicly on the February 24-26 Nationwide Conference.

Merely matching rivals’ choices shouldn’t be adequate with out totally understanding both what rivals have completed to adjust to relevant legal guidelines and laws or whether or not rivals are complying with relevant legal guidelines and laws.

The Monitor views the lack of the Monitored Entities to acknowledge when authorized session is prudent and even essential as a big shortcoming.

Different factors of concern raised by the Monitor embody:

- “the excessive focus of compensation amongst a small variety of brokers”;

- an ongoing excessive proportion of inner consumption (presumably when weighed towards retail gross sales quantity);

- continued emphasis on recruitment of FES brokers;

- FES’ “complicated and obscure” compensation plan;

- FES gross sales calls probably falling underneath Telemarketing Gross sales Rule regulation; and

- FES concentrating on African-People and Hispanics with misleading advertising and marketing

The Monitor’s impression is that, at its most base degree, the Monitored Entities are promoting a “way of life” with out explicitly saying so.

It’s noteworthy that, from their inception, the Monitored Entities’ whole community of brokers and prospects and their goal market of potential brokers and prospects are evidently center to decrease earnings people, over 95% of whom are African American or of Hispanic origin.

But, in the USA the overwhelming majority of center to decrease earnings households are white. The Monitored Entities largely ignore this big market each in geographic areas for occasions in addition to messaging.

The viewers and advertising and marketing message at UWE occasions (e.g., Tremendous Saturdays and the Nationwide Conference) are remarkably constant and tailor-made for both an African American or Hispanic origin viewers relatively than one that’s white, Asian America, Indian American, and/or of Center Jap origin.

The Monitored Entities’ themes of economic literacy, monetary success, proudly owning one’s personal enterprise, and supporting one’s household are pretty common American values throughout racial and ethnic strains.

However, the Monitored Entities clearly are narrowly centered of their method in an obvious effort at promoting a selected kind of prosperous way of life to these with low credit score scores in particular racial and ethnic teams.

Up to now FES has been receptive to suggestions made by the Monitor.

The Monitor made 13 particular suggestions within the First Report (the “Suggestions”) for the Monitored Entities to implement as adjustments of their enterprise operations so as to strengthen their compliance with relevant regulation.

The Monitored Entities apparently instituted a variety of adjustments to their operations, insurance policies and procedures primarily based on the Suggestions.

These adjustments embody:

- “updating and publicizing” firm and Agent Commonplace Working Procedures

- guide monitoring of high-earning Brokers

- implementation of an “Built-in Options Certificates Program” (coaching and training on compliance, disciplinary insurance policies, merchandise and FES as an organization)

- restructuring of service charge and month-to-month funds

- upgrades to FES’ capabilities to observe Brokers’ use of social media

- implementation of compliance coaching for FES compliance employees

- updates to “some” of FES’ advertising and marketing supplies

- better individualization of supplied credit score providers

My tackle all of that is that the whole lot is undermined if FES has and continues to derive the vast majority of its gross sales income from recruited associates.

A scarcity of retail gross sales alone is sufficient to classify FES as a pyramid scheme – and that in flip needs to be sufficient to see the FTC prevail at trial.

The Monitor’s enter on this particular level is as follows:

Agent interviews performed by the Monitor Group counsel anecdotally that some reputable demand exists for the Monitored Entities’ providers.

A number of brokers the Monitor Group interviewed indicated that their affiliation with the Monitored Entities started as prospects in want of restoring their credit score scores, or as each an agent and a buyer, with a robust curiosity within the Merchandise supplied by the Monitored Entities.

These brokers embody Alfred Nickson, Josseny Cadestin, Johnnie Newsome, Lakeisha Marion, and Victoria Sparks. It’s price noting that almost all of those are among the most extremely compensated brokers underneath the Compensation Plan.

To me that is wishy-washy. Of way more relevance could be a person breakdown of the highest earner’s downlines between retail and recruited Agent gross sales income.

That is what FES’ prime Brokers are being paid out on in any case, and it’d be necessary to find out whether or not they’re being primarily paid on recruitment or retail gross sales.

That that is being fastidiously tiptoed round suggests FES’ prime Brokers are nonetheless in all probability being paid out on recruitment. Whether or not these recruited associates have a “robust curiosity within the merchandise” is neither right here nor there.

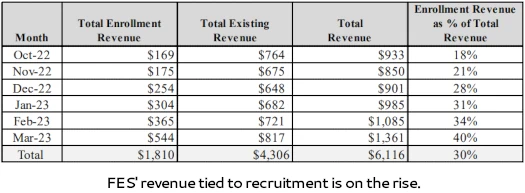

On that be aware, the Monitor gives the next knowledge;

Throughout the months of October, 2022 via March, 2023, on common, roughly 60% of Firm’s complete income was derived from gross sales to prospects who are usually not additionally brokers, with the remaining 40% of complete income derived from gross sales to brokers.

60% retail gross sales quantity has room for enchancment however continues to be a wholesome margin over the defacto 51% threshold.

Within the absence of retail gross sales quantity necessities in FES’ compensation plan nonetheless, FES’ recruitment gross sales quantity is on the rise:

If that pattern continues, retail will ultimately drop under 51%.

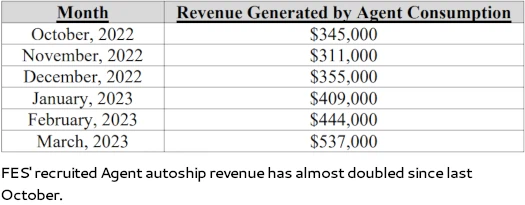

Along with failing to implement required retail gross sales quantity necessities, FES additional incentivizes pyramid recruitment via necessary autoship.

The Monitored Entities’ use of necessary inner consumption, which creates a fabric proportion of income for the Monitored Entities and incentivizes brokers to recruit different contributors so as to have their month-to-month enrollment charges waived, is a priority for the Monitor.

That is historically generally known as “pay to play”.

“Pay to play” is a robust indicator an MLM firm is working as a pyramid scheme.

One other space of concern is FES’ churn charge.

Cancellation charges amongst prospects and brokers are comparatively constant, with roughly 60% of recent prospects and brokers cancelling their participation with the enterprise by the fourth month following enrollment.

Excessive cancellation charges amongst prospects and brokers counsel an inferior Product providing and/or a non-viable enterprise alternative, elevating questions relating to whether or not gross sales are reflective of real Product demand, versus merely a value of getting into the enterprise alternative.

Tying into FES’ churn is “roughly 73% of brokers earn(ing) zero commissions”.

Roughly 50% of commissions are paid to roughly 1% of the brokers.

For these brokers incomes no commissions, when obligatory month-to-month Safety Plan funds are factored in, these brokers would seem to lose cash.

On the company finance aspect of issues, FES’ general monetary place is in decline. Throughout the corporate’s three major financial institution accounts, FES’ general money place has declined from ~$6.1 million final July, to ~$4.4 million as of March 2023.

From what I can inform, FES has utterly deserted its “Monetary Training Companies” branding to go along with United Wealth Training (UWE). I assume that is an try and distance themselves from the FTC’s ongoing lawsuit.

The FTC’s case docket reveals the FES defendants filed their solutions to the FTC’s Grievance final month.

Pending a settlement between the events, the case continues in direction of trial.