For the previous few weeks, the most popular matter within the enterprise/monetary media has been whether or not the U.S. financial system is headed right into a recession. Day by day, a parade of economists, market analysts and different pundits seem on-line, on TV and in print to provide their view on the probability {that a} recession is on the horizon.

As well as, a number of main Wall Road funding corporations have just lately estimated that the chances of a recession occurring within the subsequent a number of months have elevated.

The chances of recession are growing primarily as a result of the U.S. Federal Reserve is tightening financial coverage in an effort to rein in traditionally excessive ranges of inflation. Because the starting of this 12 months, the Federal Reserve Open Market Committee has raised the goal federal funds rate of interest 2.25%, and it has just lately began decreasing the dimensions of the Federal Reserve’s stability sheet (which tightens monetary situations).

The Committee has additionally indicated that extra rate of interest will increase are possible, and most Fed watchers predict a rise of 0.5% on the Fed’s September assembly.

Entrepreneurs must have a fairly correct image of future financial situations in an effort to develop sound advertising plans. As I’ve beforehand written, the well being of the general financial system is likely one of the main components that create the surroundings during which advertising plans can be executed. And whereas macro financial situations have an effect on totally different sorts of corporations in several methods, they may impression the success of selling efforts at most corporations to some extent.

Sadly, the outlook for the U.S. financial system over the subsequent a number of months is way from clear. The uncertainty exists for a number of causes, together with the real-world impression of Federal Reserve’s coverage selections, the persevering with issues in international provide chains, and a doable power disaster in elements of Europe this winter.

Given this excessive stage of uncertainty, the best choice for entrepreneurs is to deal with these future financial situations that may be predicted with an inexpensive diploma of confidence. For my part, we will say two issues concerning the route of the U.S. financial system over the subsequent 6 to 12 months.

- Financial development (as measured by actual GDP) is more likely to be sluggish even when we’re capable of keep away from a recession.

- Inflation is more likely to be persistent and stay above the Federal Reserve’s goal of about 2% per 12 months, though there are some indications that we could already be previous the height of inflation.

Financial Development

Actual GDP development slowed considerably within the first half of 2022. The next chart exhibits the trailing 12 month fee of actual GDP development measured on the finish of the 4 most up-to-date calendar quarters.

On the finish of This fall 2021, the actual GDP development fee over the previous 12 months was 5.5%. By the top of the second quarter of this 12 months, the annual development fee had fallen to 1.6%.

Under-average development over the subsequent a number of months is the more than likely situation as a result of it’s tough to check any occasions that may set off a rise in financial development within the brief run.

Inflation

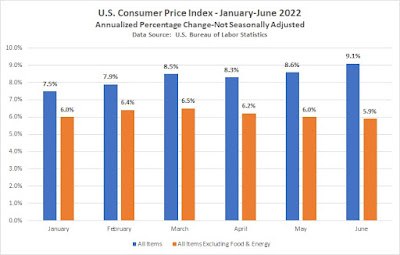

Inflation has emerged as probably the most severe concern at present affecting the U.S. financial system. The next chart exhibits the annualized fee of inflation for January by June of this 12 months as reported month-to-month by the U.S. Bureau of Labor Statistics. The chart contains each the “headline” fee of inflation (All Gadgets) and the “core” inflation fee (All Gadgets Excluding Meals & Power).

The substantial and chronic hole between headline and core inflation proven on this chart demonstrates that top gasoline and meals costs have been main contributors to inflation this 12 months. This, after all, will not be shocking to anybody who drives or eats.

Key Takeaways

For entrepreneurs, the important thing takeaway right here is that financial development is more likely to be sluggish for the subsequent a number of months. The outlook for inflation is mostly favorable, however power market analysts have famous that the majority bodily power markets are nonetheless tight. Subsequently, there’s a substantial danger that power costs may rise later this 12 months and sluggish the progress on inflation.

*PCE inflation is the proportion fee of change within the worth index for private consumption expenditures. PCE inflation is mostly thought-about to be the Federal Reserve’s “most well-liked” measure of inflation.