Cappmore FX fails to supply possession or govt info on its web site.

Cappmore FX fails to supply possession or govt info on its web site.

Cappmore FX’s web site area (“cappmorefx.com”), was first registered in November 2021.

The personal registration was final up to date on January 18th, 2023, which seems seems to be the time Cappmore FX’s proprietor(s) took possession of the area.

That is based mostly on Cappmore FX’s official FaceBook web page being created in March 2023.

Additional analysis reveals Cappmore FX associates citing Ajay Arya as CEO of the corporate.

Aside from noting Arya seems to be an Indian nationwide, I wasn’t in a position to put collectively a verifiable historical past.

Cappmore FX advertising and marketing materials cites Arya as founding father of “The Teachable Tech”:

This corresponds with Saksham Buying and selling Academy, an Indian firm providing foreign currency trading programs:

We, SAKSHAM TRADING ACADEMY (The Teachable Tech), located at Karad, Maharashtra are one of many main institutes for inventory market buying and selling and provide one of the best and uniquely designed programs.

This may recommend Cappmore FX can be being operated out of India.

As at all times, if an MLM firm just isn’t overtly upfront about who’s working or owns it, suppose lengthy and exhausting about becoming a member of and/or handing over any cash.

Cappmore FX’s Merchandise

Cappmore FX has no retailable services or products.

Associates are solely in a position to market Cappmore FX affiliate membership itself.

Cappmore FX’s Compensation Plan

Cappmore FX associates make investments funds on the promise of passive returns:

- Basic – make investments $10 or extra

- Elite – make investments $500 or extra

- ECN – make investments $2500 or extra

The MLM aspect of Cappmore FX pays on recruitment of affiliate buyers.

Referral Commissions

Cappmore FX pays a fee on personally recruited associates who make investments.

Referral fee charges are decided by how a lot a newly recruited Cappmore FX affiliate invests:

- recruit a Basic tier affiliate and obtain $6

- recruit an Elite tier affiliate and obtain $9

- recruit an ECN tier affiliate and obtain 12

ROI Match

Cappmore FX pays a ROI Match through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel group, with each personally recruited affiliate positioned instantly underneath them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel group.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Cappmore FX caps the ROI Match at 5 unilevel group ranges.

The ROI Match is paid as a share of passive returns obtained throughout these 5 ranges as follows:

- degree 1 (personally recruited associates) – 8%

- degree 2 – 2%

- degree 3 – 1%

- ranges 4 and 5 – 0.5%

Becoming a member of Cappmore FX

Cappmore FX affiliate membership is tied to an preliminary minimal $10 funding.

Cappmore FX Conclusion

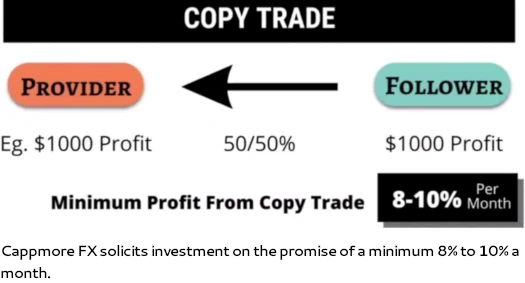

Cappmore FX represents it generates exterior income through copy buying and selling, purportedly tied to foreign exchange and CFD buying and selling.

Cappmore FX is an trade chief within the foreign exchange & CFD markets.

It’s our promise to ship a strong, user-friendly, and honest buying and selling platform.

SimilarWeb tracks negligible web site site visitors for Ajay Arya’s different firm, Saksham Buying and selling. This means Shaksam Buying and selling is a failed enterprise, and so now we now have Cappmore FX.

The issue with Cappmore FX is Ajay Arya is pitching a “minimal 8% to 10% a per thirty days”.

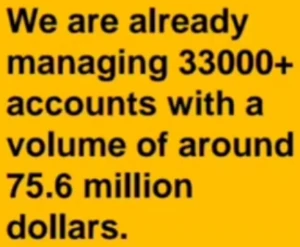

That alone is problematic however, regardless of solely present for a number of months, Cappmore FX additionally claims to already be managing $75.6 million.

8% of $75.6 million involves a minimal of $6 million {dollars} a month.

8% of $75.6 million involves a minimal of $6 million {dollars} a month.

If Cappmore FX is already making that quantity every month;

- why are they promoting entry for simply $10; and

- why do they want your cash in any respect?

On the regulatory entrance, Cappmore FX just isn’t registered to supply securities in any jurisdiction. Which means at a minimal, Cappmore FX is committing securities fraud.

If Cappmore FX was legitimately buying and selling at a minimal of 8% to 10% a month, why would they function illegally by committing securities fraud?

If we mix Saksham Buying and selling having failed, Cappmore FX committing securities fraud and its enterprise mannequin and advertising and marketing making no sense, we’re left with a fraudulent funding alternative that’s doubtless a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This can starve Cappmore FX of ROI income, ultimately prompting a collapse.

The maths behind Ponzi schemes ensures that after they collapse, nearly all of members lose cash.