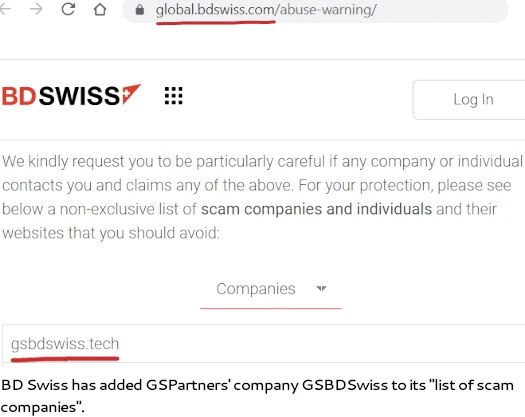

BDSwiss has listed GSPartners’ shell firm GSBDSwiss in a printed abuse warning.

BDSwiss has listed GSPartners’ shell firm GSBDSwiss in a printed abuse warning.

BDSwiss warns that GSBDSwiss is a “rip-off firm … that it is best to keep away from”.

BDSwiss goes on to state;

Furthermore, please bear in mind that it has just lately come to our consideration that numerous rip-off corporations contact our shoppers misleadingly and falsely claiming that both:

a) they’re a part of our Group, or

b) they’re our enterprise companions or in every other methods affiliated with us, or

c) clone corporations, making an attempt to make use of our firm data, licenses and so on. with one other model title or altering any vital contact data as a way to get hold of any consumer or private data;

d) they declare to be regulated by Fictitious Regulators, or

e) they declare to be regulated however should not, with the aim of luring our shoppers into beginning a enterprise relationship and/or depositing cash and/or making an attempt to acquire helpful delicate data of shoppers as a way to hack their accounts or in any other case hurt them.

We wish to underline that BDS Ltd has no affiliation by any means with the above talked about corporations and people.

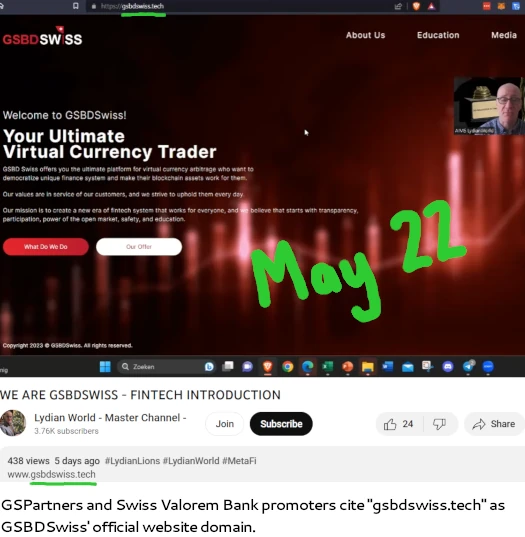

The web site area (“gsbdswiss.tech”), was privately registered on Might seventeenth, 2023.

There is no such thing as a point out of GSPartners, mother or father firm GSB Gold Commonplace Financial institution or proprietor Josip Heit on GSBDSwiss’ web site.

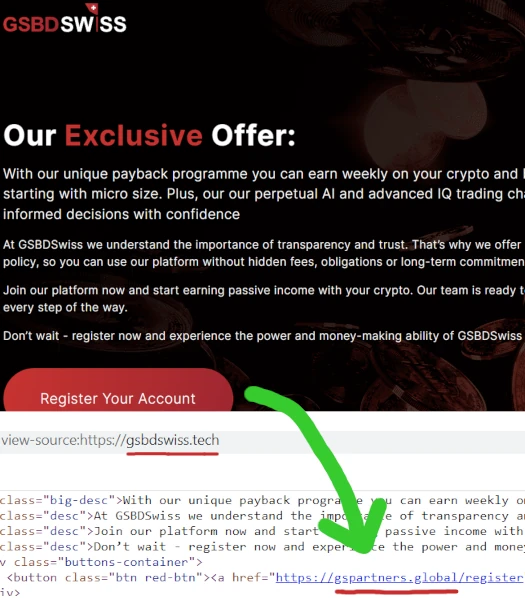

Within the footer of GSBDSwiss’ web site, in precisely legible darkish gray textual content, the corporate discloses GSBD Swiss LTD is a shell firm included in Kazakhstan. Crypto providers are supplied by CoinX24 AG, a shell firm included in Switzerland.

If guests to GSBDSwiss’ web site click on on the “join” button, they’re redirected to GSPartners’ web site area:

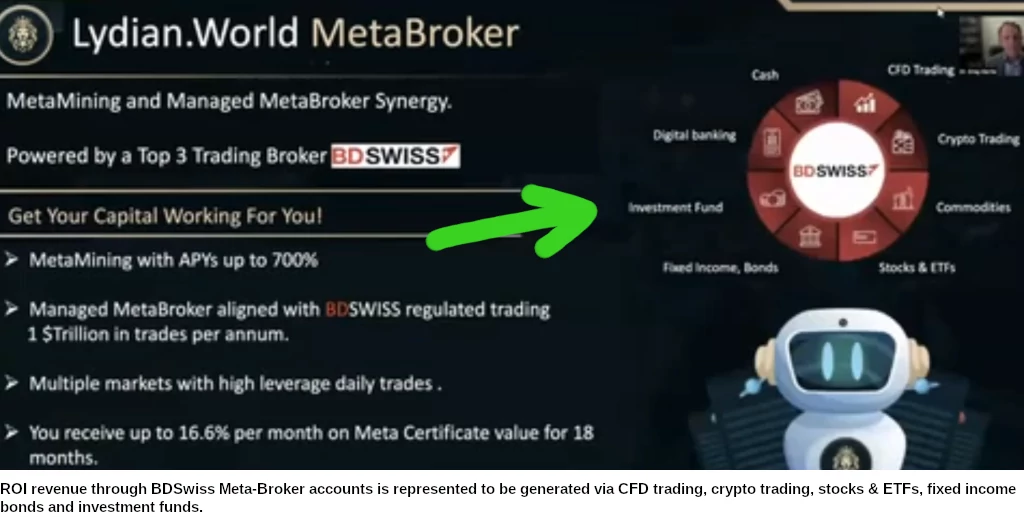

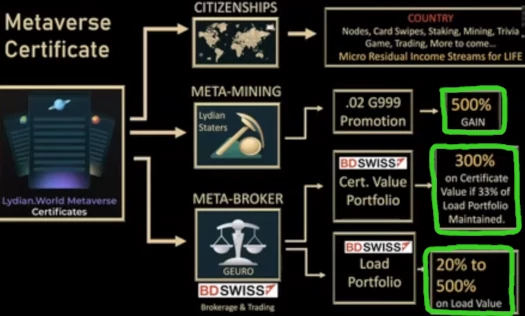

Beginning mid 2022, GSPartners represented it had a partnership with BDSwiss to market its “metaverse certificates” funding scheme.

This prolonged to together with BDSwiss’ trademark on its web site and advertising materials.

The ruse behind GSPartners’ “metaverse certificates” was BDSwiss was buying and selling to offer traders a 300% ROI over 18 months (click on to enlarge beneath):

In January 2023, BDSwiss confirmed it by no means had a partnership with GSPartners or any of its related corporations.

It has come to our consideration that for fairly a while now, GSPartners Group, Lydian.world, Gold Commonplace Financial institution, and/or their associates have been on a publishing expedition of content material explicitly that includes our model and registered emblems, suggesting an affiliation and/or cooperation with us.

We hereby want to set the report straight by informing you that we’ve by no means began any sort of cooperation or affiliation with GSPartners Group, Lydian.world or Gold Commonplace Financial institution.

This affirmation noticed GSPartners change to claiming its partnership was with Skyground Group in February 2023. That lasted a month, earlier than Skyground Group was changed with GSBDSwiss.

Round March 2023, GSPartners changed BDSwiss’ emblem within the affiliate backoffice with GSBDSwiss.

In March and April 2023, Canadian regulators issued a number of GSPartners securities fraud warnings.

In Might 2023, GSPartners rebranded as Swiss Valorem Financial institution. This seems to be a direct response to regulatory warnings in opposition to the corporate.

As of Might 2023, Swiss Valorem Financial institution continues to make use of GSBDSwiss branding within the affiliate backoffice:

As famous by BDSwiss, GSBDSwiss just isn’t registered to supply securities in any jurisdiction. This extends to GSPartners, Swiss Valorem Financial institution and Josip Heit.

BDSwiss directs GSPartners and Swiss Valorem Financial institution traders with additional enquiries to contact their help;

We are going to be pleased about any details about misuse or try of misuse of our model names, web sites, licences or providers and can take any applicable steps to guard our shoppers and our enterprise.

Alternatively, BDSwiss suggests traders contact monetary regulators in Cyprus (CySEC), the UK (FCA), Germany (BaFin) and the US (SEC).