In response to a Californian securities fraud stop and desist issued final week, NovaTech FX has rolled out securities fraud pseudo-compliance.

In response to a Californian securities fraud stop and desist issued final week, NovaTech FX has rolled out securities fraud pseudo-compliance.

In an “pressing request” despatched out to NovaTech FX buyers over the previous 24 hours, the Ponzi scheme is demanding they

undergo your posts on Social media (Fb, Instagram, Twitter, YouTube, and many others) and be sure that any/all posts with an ROI or ANY commercial, solicitations which have NOVATECH’s identify or brand on it… will get DELETED IMMEDIATELY & with out hesitation!

If you happen to see anybody doing so, please kindly talk/inform them accordingly. Not deleting/ eradicating such posts might result in having their NOVATECH account closed.

The issue after all is that, no matter what you name your fraudulent funding scheme, it’s nonetheless a fraudulent funding scheme. Therefore the time period “pseudo-compliance”.

MLM associated securities fraud within the US begins with the identification of an funding contract. That is carried out by way of the Howey Take a look at.

Beneath the Howey Take a look at, an funding contract exists if there’s an “funding of cash in a standard enterprise with an inexpensive expectation of earnings to be derived from the efforts of others.”

With respect to NovaTech FX, it itself is the “frequent enterprise”. Associates make investments on the promise of a weekly ROI, which satisfies “an inexpensive expectation of earnings”.

NovaTech FX represents passive returns are funded by way of buying and selling, satisfying “earnings to be derived by way of the efforts of others”.

And so having happy all prongs of the Howey Take a look at, NovaTech FX’s MLM alternative constitutes a securities providing underneath US regulation.

This shouldn’t come as a shock. BehindMLM recognized NovaTech FX as an unregistered securities providing in 2019.

We preserve that any MLM firm committing securities fraud does so as a result of it’s a Ponzi scheme.

Getting again to regulation, the existence of an funding contract means NovaTech FX has to register with the SEC and be submitting periodic audited monetary experiences.

They aren’t – and that is doubtless what is going to immediate an SEC lawsuit in some unspecified time in the future.

Traditionally when states begin issuing securities fraud stop and desists the SEC isn’t far behind. When the federal regulator pulls the set off nonetheless can’t be predicted with accuracy. Ditto whether or not the DOJ will combo legal fees.

Actually there was a latest pattern of US authorities going not solely after firm homeowners, but additionally prime promoters of MLM Ponzi schemes.

Whereas buyers will scramble to fulfill NovaTech FX’s “delete the proof” directive, it gained’t have any impact on pending regulatory proceedings.

The SEC and DOJ have by no means misplaced a securities fraud associated case as a result of proof was deleted and “this isn’t monetary recommendation”.

What’s going to immediate buyers to adjust to NovaTech FX’s calls for is the specter of dropping their funding account(s). The irony being that it’s after all already too late to withdraw.

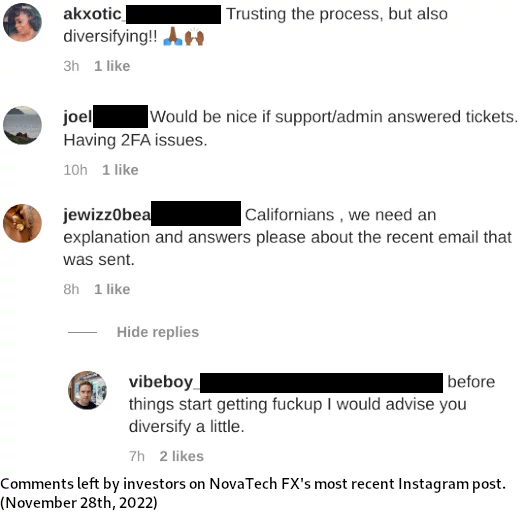

NovaTech FX buyers acquainted with Ponzi scheme end-games are already advising others to “diversify”

“Diversify” is scam-speak for “withdraw every little thing”.

At time of publication NovaTech FX has not publicly addressed California’s securities fraud stop and desist. Pending any further updates, we’ll maintain you posted.