Decrease-priced private-label manufacturers have been a mainstay of enormous U.S. grocery chains for years. Non-public labels have change into much more common over the previous two years owing to giant will increase in meals costs.

In consequence, U.S. grocery retailer model gross sales in 2022 rose 11.3%, virtually double the expansion of nationwide manufacturers, in keeping with the Non-public Label Producer’s Affiliation.

Non-public-label items are additionally common in Europe, particularly for groceries. In Western Europe, personal labels have a penetration price of 40%, with Central and Jap Europe coming in at 30%, in keeping with Statista. Customers within the U.Okay. are significantly avid private-label purchasers.

However shoppers’ acceptance of store-brand groceries doesn’t translate to different retail merchandise. High quality, or the notion of high quality, issues for these objects.

Following are tales of retailer success and failure.

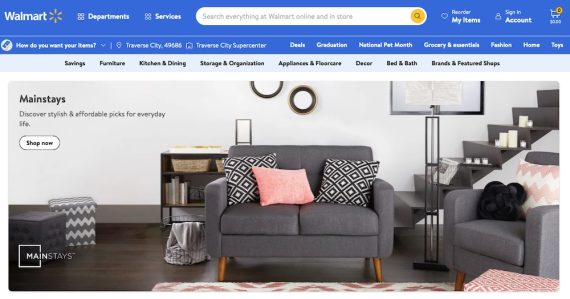

Walmart

The retail behemoth has been promoting personal label manufacturers, largely in its grocery line, for over 30 years. Nice Worth (family necessities) and Equate (well being and private care) are two of its hottest. It additionally sells a sturdy collection of attire, toys, and different objects.

All informed, Walmart has roughly 300 personal label manufacturers throughout 20 classes and 29,000 merchandise, together with:

- Mainstays. Bedding, kitchen utensils, dwelling furnishings.

- Time and Tru. Ladies’s clothes, footwear, equipment.

- Marvel Nation. Infants, toddlers, older youngsters.

- House Traits. Furnishings, home equipment, dwelling décor.

- EverStart. Batteries and equipment from Johnson Controls and offered solely at Walmart.

Amazon

Estimates differ broadly on the variety of Amazon’s private-label merchandise. In response to questions from a Congressional committee in 2019, Amazon revealed it provided 158,000 private-label merchandise.

Earlier this month, EcomCrew, a podcast and weblog, estimated Amazon had 88 in-house manufacturers. Amazon Fundamentals account for about 58% of all Amazon personal label gross sales worldwide, in keeping with Statista.

Among the many prime manufacturers are:

- Amazon Fundamentals. Batteries, kitchen, workplace, pet, bedding, storage, journey, music, audio.

- Amazon Necessities. Clothes.

- Amazon Primary Care. Well being and private care.

- Amazon Assortment. Jewellery.

- Amazon Parts. Dietary supplements.

- Amazon Conscious. Carbon-neutral merchandise.

- Solimo by Amazon. Meals, well being, child, magnificence, dietary supplements, home goods.

Many Amazon market sellers have accused the corporate of competing with them by utilizing their gross sales knowledge to seek out the most well-liked merchandise after which manufacturing them. Amazon has denied these claims and said that personal labels make up lower than 3% of total gross sales.

Nevertheless, in 2020, the European Fee accused Amazon of utilizing its clout and knowledge to compete with retailers utilizing its platform and threatened to take motion in opposition to the corporate.

Final July Amazon introduced plans to cut back the variety of personal manufacturers, citing weak gross sales. The transfer might decrease the quantity by as a lot as 50%, per The Wall Road Journal.

Goal

Goal’s private-label manufacturers are among the many most profitable of main retailers. It began with groceries after which moved to attire. Goal is thought for high quality, and its “low-cost stylish” picture is common with youthful shoppers. It has 48 personal manufacturers in numerous classes and intends to broaden this 12 months. Ten of them have gross sales of not less than $1 billion. Roughly 15% of Goal’s income for grocery, family, and well being and sweetness objects comes from its personal labels.

Among the many hottest are:

- Market Pantry, Good & Collect. Meals.

- A New Day. Attire.

- All in Movement. Activewear

- Made by Design. Housewares, baggage.

- Up & Up. Private care

Mattress Tub & Past

Not each personal label initiative is profitable. In 2019, struggling Mattress Tub & Past employed Goal’s chief merchandising officer Mark Tritton as CEO to spearhead a turnaround. Tritton rapidly applied a personal label technique, chopping again on nationwide manufacturers. This proved unsuccessful because the chain’s clients most popular title manufacturers. Some analysts prompt the corporate didn’t allocate ample assets to the idea.

Even in inflationary occasions, personal labels require a great deal of work.